Buying your first home can seem overwhelming. But if you break it down step-by-step, the process will become much more clear and less anxiety filled. Our First Time Home Buyers Guide walks you through the process, and the information below helps you start thinking about the process at hand.

1. Before you begin looking at properties

Sit down and make a list of what is important to you in a home. This is the time when you can start visualizing your perfect home. As you start to see properties, these choices may change, and that’s OK! It may sound silly to make a list but when faced with some tough choices, this list will help put things in perspective and you will be glad it’s in writing. As time goes on, you may find that many of your “must haves” have become optional as you become more familiar with the local real estate market.

- Do you have a preference regarding when the house was built? What type of home are you looking for (e.g., single-family, condo, townhouse, new build, etc.)?

- What size house are you looking for (square footage)?

- Do you want a house in move-in condition or are you willing to do some work on it?

- How many stories would you like or do you prefer a ranch style?

- What size lot would you like?

- What architectural styles do you prefer?

- What type of exterior siding will you consider?

- What are you looking for in terms of a garage (e.g., attached, carport, etc.)?

- Do you want a fireplace, porch, deck, swimming pool, hot tub?

- Are you OK with an HOA?

2. Other lifestyle preferences to consider

- Areas/neighborhoods you would enjoy

- Specific streets you like

- School district(s) you prefer

- Your work location(s)

- Your favorite shops/conveniences/grocery store/coffee shop

- Nearby recreation/athletic clubs/parks you enjoy

- Will you use public transportation? Is the home close to the RTD light rail or a bus stop?

3. Now that you know what you want, here’s how to find it

You can contact Usaj Realty and we can set you up with email alerts when homes that fit your criteria hit the market.

4. Next, examine your finances

Scrutinize your credit report for errors before you apply for a loan. That way you will get approved for a loan with an appropriate interest rate. Next, get pre-qualified for a mortgage from your banker or lender who will explain the various types of loans and what kind of loan would be best for your situation. Later on, you will get pre-approved for your mortgage.

Everyone’s financial situation is unique. Here are two general rules:

1. Focus on homes that cost about 3 to 5 times your annual income. A 20% down payment allows you the best terms/interest rate but lower down payments are also available (3-5 percent in some cases), especially for first time home buyers. Check with your lender on the pros and cons of selecting a lower down payment.

2. It’s a good rule of thumb to spend no more than 28% of your gross monthly income on mortgage payments, property insurance and property taxes (**This is general advice, your situation might be different. Ask a mortgage lender for specific details, or contact us for recommended lenders). You don’t want to be overextended on your monthly payment; living below your means is always preferred, especially when you may want to make home improvements, buy new appliances and upgrade your living space in future years.

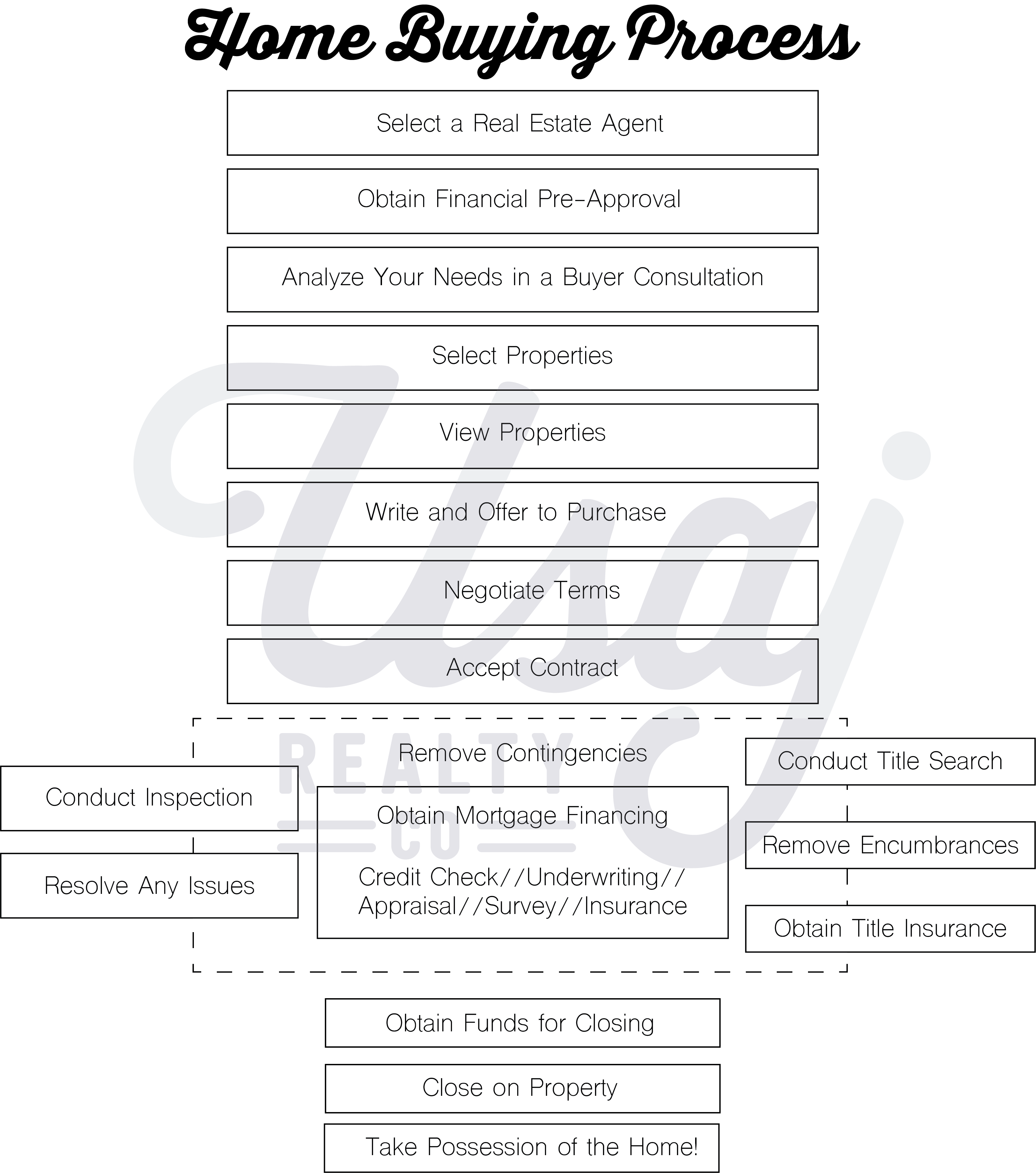

At this point, you will know your price range and should begin working with your realtor to start shopping for a home. This chart shows the entire purchasing process. Usaj Realty will be there to walk you through every step of the way.