Buying a mountain home is a dream for many Colorado residents and non-residents alike.

Whether you strive to live in a smaller town, dream of being closer to skiing and other outdoor activities, or just want a slower pace of life, mountain living is a hope and aspiration for many. Additionally, many people approaching retirement wish to downsize and mountain communities offer opportunities to do just that.

Roughly 70 percent of the 5.8 million Colorado residents live along the Front Range urban corridor that runs from Fort Collins to Pueblo. This 180 mile stretch of land has attracted 91 percent of the newcomers to the state, according to an article in the Colorado Sun.

However, many mountain communities are seeing increases in population as well. For example, in the last 20 years, these counties have shown more than a 9 percent increase in population: Teller, Custer, Archuleta, San Juan, San Miguel, Chaffee and Saguache. At least 10 other Colorado mountain counties have seen over a 6 percent increase in the populace during the same time frame.

If you’re considering taking the leap from urban to mountain living, it’s important to understand the intricacies that come with quasi- or full-on rural life. Yes, you may want great views and a slower pace of life but there are many trade-offs that may affect your standard of living. Living in less populated areas has its advantages but there are also some significant trade-offs to keep in mind before committing to this new lifestyle.

Determining What Your Dream Home Will Look Like

Like urban areas, most mountain communities offer a variety of housing options. Single family, condos, townhomes and even manufactured and mobile homes are possible structures to call home.

{{cta(‘684cd0d3-8a91-46cc-8814-5837b4726ee0’)}}

When considering a single family home, you’ll have to decide whether it’s important to you to live “in town” or desire the privacy that comes with owning acreage on the outskirts of the community or even in unincorporated areas. Is it important to you to have neighbors close by in the case of an emergency? Do you want a view? What is the zoning and how might it impact your property value? Are there neighborhood covenants/code enforcement that addresses issues like noise, barking dogs, and excess cars/trucks/RVs parked on the street or driveways?

If you’re looking to downsize, condos and townhomes are often the housing of choice. Because there are common walls and roofs, these homes are generally less expensive than single family homes. Most of the time, these multifamily units are maintained through a homeowner’s association. A monthly fee is charged for residents that covers common area maintenance (mowing, weeding, snow removal, etc.), property improvements and sometimes even water. Keep in mind HOA fees may fluctuate over time so it’s important to properly budget and determine if the organization is fiscally responsible.

Utilities, Internet, Water, Trash Pickup and Other Essentials

When you’re an urban dweller, you probably don’t even think about these necessities. However, once you move away from large cities, the landscape can change dramatically when it comes to day-to-day conveniences that you may have taken for granted.

Internet Access: If having high speed internet is important to you, it’s advisable to check with the local providers in the mountain communities that are on your wish list. Unfortunately, there are still many small towns all over Colorado that still don’t have access to fast internet. This is especially important if you’re planning to work remotely and require consistent access.

Water: If you’re living in town, you’ll most likely be connected to the city water supply. However, many mountain homes outside the city have their own wells. Make sure you know the age of the well and how deep it was drilled. Have there been any issues with the water? Is a water softener necessary? Has the well been properly maintained?

Sewer/Septic: Like the water supply, if you’re in the city limits, your home will most likely be connected to the city sewer. Homes outside of the city are likely on septic systems. Ask for records regarding the septic system to determine its age, if it’s functioning properly and has been adequately maintained.

Roads/Property Access: Dirt roads abound in mountain communities and your dream home may require use of these unpaved avenues. Even in the city limits, there can be streets that haven’t been paved. Inquire with the county or other agency to determine who maintains the road, especially in the winter. As you might expect, dirt roads can become rutted and/or develop the washboard effect. If there is no road maintenance in the winter, you’ll have to arrange for snow removal.

Electricity: Unless you’re looking to build a home, most properties are already hooked up to electricity. That being said, winter storms can knock out power, sometimes for days. Back-up generators are often recommended to tide you over during these times.

Food/Supplies: Consider the drive to the stores for groceries, gas and other necessities. Living in the mountains may require you to get a bit more organized to make sure you pick up all your essentials. Making multiple trips to the store can be a major time suck and negate the whole premise of why you decided to move to the mountains!

Unlike large urban cities, there aren’t always Wal-Marts, Targets and Costcos nearby. Instead, there are local merchants who are vital to these towns. Keep this in mind when considering how to help with the local economy and be part of your new community. Buying local is important in these small cities.

Factor In Additional Costs

While some mountain communities offer lower property taxes, some may be more in line with that of urban areas. Increasing property values, more money being directed to schools and special assessments all play into determining what the taxes will be on your home/property. Do your research and see what the trends have been with property taxes. Are there ever special assessments? What has been the history of ballot measures that impact property taxes?

Furthermore, homeowner’s insurance may often be higher, especially as it relates to wildfire coverage. As we have seen over the last few years, the threat of forest fires has been increasing in the state and mountain homes are often in the path of destruction. You may want to check ahead on how much homeowner’s insurance will cost in the areas that you’re considering.

Conclusion

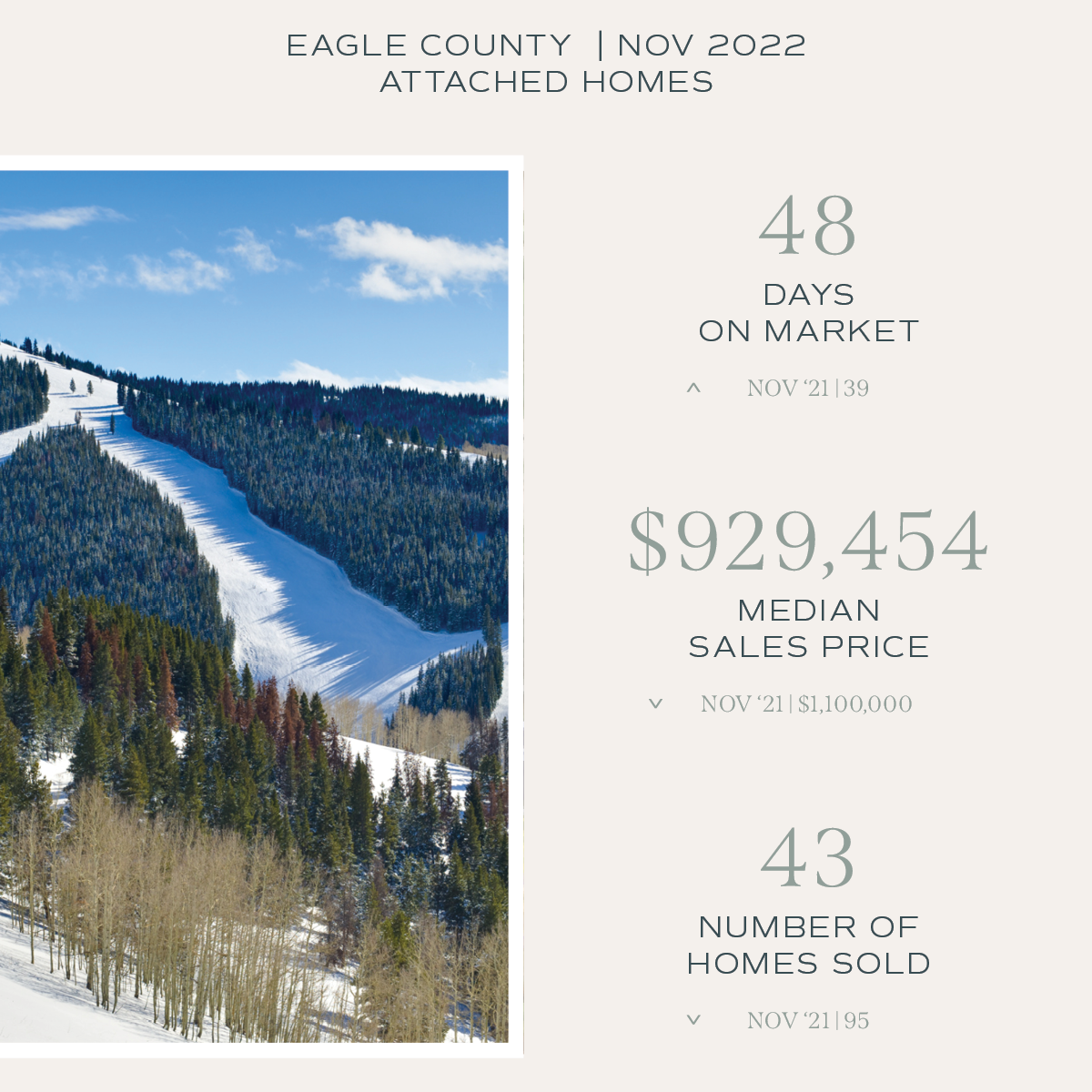

It’s important to understand the real estate market in the area of your potential mountain home, both in the short- and long-term. Regardless of whether you’re planning to live there for 5-7 years or it’s your forever home, know the market and how long it may take to sell your home in the future. Some mountain communities lie in very hot markets right now; others, not so much.

Furthermore, if you are planning to remodel your home, select the home improvements that would appeal to not just you but a future buyer as well. Keep in mind, the best renovations to a mountain home may not be the same as those you’d see in urban areas. Your real estate agent should be knowledgeable about what amenities and features are in demand in a particular area.

Always keep in mind what the return on your investment will be and whether it will benefit you in the long term.