With a noticeable shift occurring in the Denver real estate market, it’s more important than ever to understand the ins and outs of getting approved for a mortgage and the associated costs of buying a home.

Rising interest rates, the heavy emphasis on your credit score, down payment and whether to decide to pay mortgage points will all be calculated in determining what your monthly payment will look like.

So what goes into a monthly mortgage payment?

First and foremost is the actual loan that you’ll secure from a lender which will include the principal and interest, and likely an escrow account covering private mortgage insurance (if there is less than a 20 percent down payment), homeowner’s insurance and property taxes.

As a result, it’s important to feel comfortable with the loan you’ll be getting and how it will impact your budget and bottom line.

Amy Ivy with Cherry Creek Mortgage provides answers to some of the common questions homebuyers have about mortgages and how to get a monthly payment that best fits your budget. She discusses mortgage rates, best loan terms, paying mortgage points, down payment options and locking in a rate that can help you achieve a favorable monthly mortgage payment.

How are current mortgage rates having an impact on home buyers?

Amy: Right now, mortgage rates are the proverbial “elephant in the room.”

There is no doubt about it, higher interest rates do mean that the cost of borrowing money is more expensive, and oftentimes can limit the purchasing power of many home buyers. That being said, higher interest rates have taken some people out of the buying pool, allowing for the best opportunity to get into a home that we have seen in a long time. We are experiencing less overall competition and home buyers are now able to negotiate closing costs and purchase price, which is vastly different from the market earlier this year. In the current Denver area housing market, if you can qualify and manage the higher rates, it could be a real opportunity to purchase a home.

We are experiencing less overall competition and home buyers are now able to negotiate closing costs and purchase price, which is vastly different from the market earlier this year.

Changes in interest rates can have both positive and negative effects on the markets. Central banks often change their target interest rates in response to economic activity: raising rates when the economy is overly strong and lowering rates when the economy is sluggish.

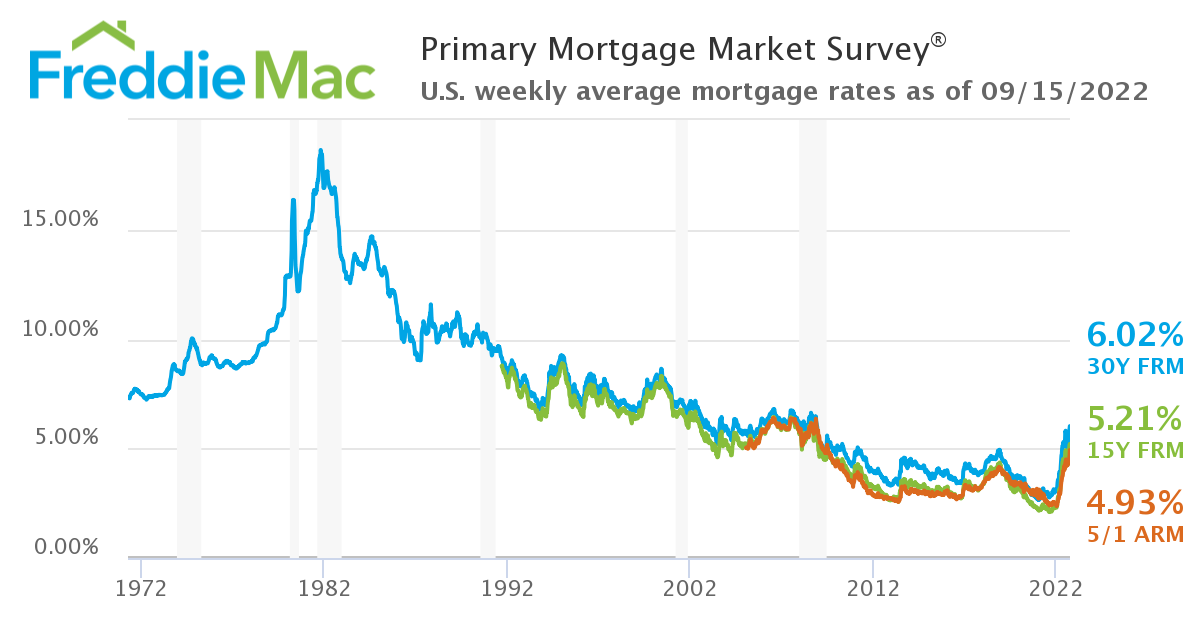

While interest rates are higher than they have been in several years, they are still low historically speaking. Simultaneously, home prices are at historic highs; therefore, the impact of higher rates is more meaningful to many people.

Don’t forget that you aren’t “stuck” with your interest rate forever! You certainly want to make sure you are comfortable with your initial rate and payment but remember, there will likely be an opportunity in the future when we see lower interest rates and buyers will have the chance to refinance into that lower rate.

How does your credit score play into getting a favorite rate?

Amy: Lenders use credit scores as an indication of risk and rely on them as a barometer of whether a borrower is likely to meet financial obligations.

Generally speaking, the higher the score, the less risk, and conversely, the lower the credit score, the more risk assumed by the lender.

A credit score of 700-plus will usually land a borrower a lower interest rate, and while mortgage industry experts say you can still qualify for certain loans with a score under 680, the 700s are where you can expect to pay the lowest rates.

Creditors set their own standards for what constitutes an acceptable score, but these are general guidelines:

- A score of 740 or higher is generally considered excellent credit.

- A score between 700 and 739 is considered good credit.

- Scores between 620 and 699 are fair credit.

- And scores of 619 and below are poor credit.

There is some leniency on credit scores and underwriting guidelines with government loans (FHA, VA, USDA). But the loan fees are more expensive: you’ll have to pay mortgage insurance as well as an upfront and an annual and ongoing mortgage insurance premium for an FHA loan.

You should always consult your mortgage advisor to come up with the product and strategy that will work best for you.

What are ‘loan terms’ and how do they affect your rate and monthly payment

Amy: “Loan terms” is a broad way to describe the various details of a loan, including the repayment period, monthly payments, and costs.

The loan repayment period is the first term we will look at. Often referred to as the term of the loan, this is the indicator of how long you have to pay back the mortgage obligation (the money that you borrow). The most common term in the residential space is a 30-year fixed rate loan, but you could consider a shorter term as well: 20-, 25- and 15-year terms are also common depending on the specific goals a borrower has.

The longer your loan repayment period, the lower your monthly payment may be, but a longer loan repayment period can also translate to more interest paid in total over the life of the loan.

You might be able to get a lower interest rate with a shorter term, like a 15-year fixed rate loan, but the payment will be higher because you are spreading the payback period of the total loan amount over a shorter period of time.

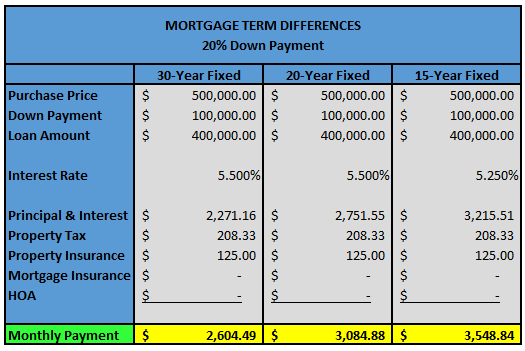

Additionally, an Adjustable Rate Mortgage (ARM) might be attractive in certain situations, but those can be very complicated. For this discussion, we are going to stick with a fixed-rate loan. Below is an example of how the term of the loan affects the monthly payment. You will notice that even with a lower rate on the 15-year fixed loan, your payment is almost $1,000 higher per month.

Interest rates are the other major component of your monthly loan payment. The higher the rate, the higher the payment will be. While there are many factors that impact the overall rates (economic health, supply/demand, inflation, geopolitical factors, government intervention, special circumstances), there are several factors that are controllable by the borrower. Those include: credit score, loan amount, loan-to-value, type of home, loan program (VA, FHA, conventional), and loan term.

Some additional terms that will impact your loan are:

- Origination fees – these are all lender costs and impact the rate offered. All lenders present these fees differently. Make sure you understand these different fees. (Not all fees are created equal).

- Closing costs – the components of these should be consistent among lenders, but the amount charged can differ.

- Prepayment penalties – most loans don’t have a prepayment penalty; however, you want to be sure and ask your lender to confirm.

- Application fees – some lenders will require you to pay fees upfront to cover the cost of your appraisal and other fees in the event the loan does not close.

As mentioned above, typically there are no prepayment penalties on residential loans. This means that if you take a longer-term loan, you can always choose to pay more each month if your budget allows which would mean you pay less interest and pay your balance due more quickly. As a general rule of thumb, paying only one extra monthly mortgage payment annually can cut years off of your loan and save you tens of thousands of dollars in interest.

What are mortgage ‘points’? How can they help?

Amy: Bottom line: points can help you get a lower interest rate.

Mortgage points are the cost of the interest rate specific to your transaction. When a lender refers to buying points, they are referring to a borrower paying an additional amount up front, to permanently lower their interest rate through the life of the loan. How much a point costs varies greatly and is dependent on the strength of the loan profile (loan to value, credit score, loan amount).

When a lender refers to buying points, they are referring to a borrower paying an additional amount up front, to permanently lower their interest rate through the life of the loan.

It is critical to understand that all lenders structure the rate costs differently, so when comparing lenders, you should be careful to compare apples to apples. There is a “cost” to EVERY rate. Some lenders may charge processing fees, underwriting fees and/or origination fees while others may not. These are all technically costs for a rate, wrapped into a differently labeled box. Accepting a higher rate may even allow you to receive a credit towards your closing costs.

Consumers should be aware that ‘points’ are tax deductible because they are classified as prepaid interest. However, other origination charges (processing fees, underwriting fees) are not deductible from your taxes. You can see that comparing loans from different lenders side by side can quickly become fairly confusing. The best way to do this simply is to get a loan estimate (this can’t happen until you are under contract on a home). Additionally, if you have a lender you trust, most would be happy to help borrowers compare the different formats and tell you what the differences are.

How does your down payment impact your loan?

Amy: The down payment is the amount of money that a borrower will bring to closing as the initial payment towards the purchase of the home. A down payment will determine your overall loan amount, which will impact your overall monthly payment. Generally speaking, the larger the down payment, the smaller the loan and the lower your monthly payments. While the minimum down payment required varies by loan type and whether you have owned a home in the past 3 years, the more you put down as a buyer, the less the risk the lender takes. Therefore, if you put less money down on a home at closing, you might anticipate paying more in fees and interest over the loan’s lifetime.

The amount of your down payment can impact the interest rate offered, and any down payment less than 20% of the sales price will require the borrower to carry private mortgage insurance (PMI). However, the cost of private mortgage insurance isn’t as expensive as it once was and there are many instances where it can make sense to put less money down and carry the cost of PMI. You should definitely explore all of the options with your lender.

Why should you lock in a mortgage rate?

Amy: A mortgage rate lock protects you from the frequently cycling nature of interest rates. Even if rates increase, you’ll retain your previously quoted, lower rate when you close on your new loan. That said, if interest rates go down after you lock your rate, you’ll miss the opportunity for a lower rate.

Determining whether you should lock your mortgage rate depends on several factors. Consider the current mortgage rate in your area, as well as your financial situation including your credit score. Also, keep in mind the current economic climate and the risk that rates may rise or fall in the near term.

If you believe that your current rate is competitive with others in the area and is a rate that you can afford, it is worth locking into your mortgage rate. Some buyers cannot qualify for the same loan if rates go up, so it would be in their best interest to lock in a rate that insures them the ability to close on the home. Locking in your rate can provide additional certainty and peace of mind in an otherwise sometimes volatile market.

Typically, your lender can help to guide this decision as they are always attending to the markets. They should be able to alert you when rates drop, rise or are expected to make a large change so that you don’t miss an opportunity. Usually, a borrower’s risk tolerance will help determine when to lock. I often compare locking a rate to betting in Vegas. Locking is a gamble of sorts. One piece of advice I tell my clients is that if you like a rate, lock it…BUT once you do lock, don’t torture yourself by continuing to watch rates!

And contact Amy Ivy with Cherry Creek Mortgage to learn more about your mortgage loan!