In the home buying process, there are no two sweeter words than “under contract.”

For both the home buyer and home seller, this simple phrase signifies the end of one journey and the start of another. Certainly, there’s always the possibility of blips in the process but in most cases, this moment means the sale is imminent.

Being under contract means that a mutually approved document has been drawn up and both parties have accepted the terms of the contract. In addition to the price, a good contract should address a number of items including inclusions/exclusions, contingencies (a list of conditions or actions that must be met before a contract becomes binding) and other specifics about the sale.

There are a myriad of forms and tasks you will have to accomplish in a relatively short period of time once you are under contract. Knowing how much time you’ll need to close is important, both for the buyer and the seller. Typically, a closing takes 35-45 days — not a long period of time! Unless your are purchasing a home with cash, the buyer’s lender dictates the length of time it will take to close. As a result, it’s imperative to have your loan pre-approved before getting too deep into the process. It’s vital to look at the big picture and have a detailed list of what needs to be accomplished during “closing time.” It’s during this time that an experienced real estate broker is worth her/his weight in gold.

It’s a good idea to have a punch list of “to do” items during this phase. That way, you can keep track of what you have to accomplish and what your real estate broker is responsible for completing.

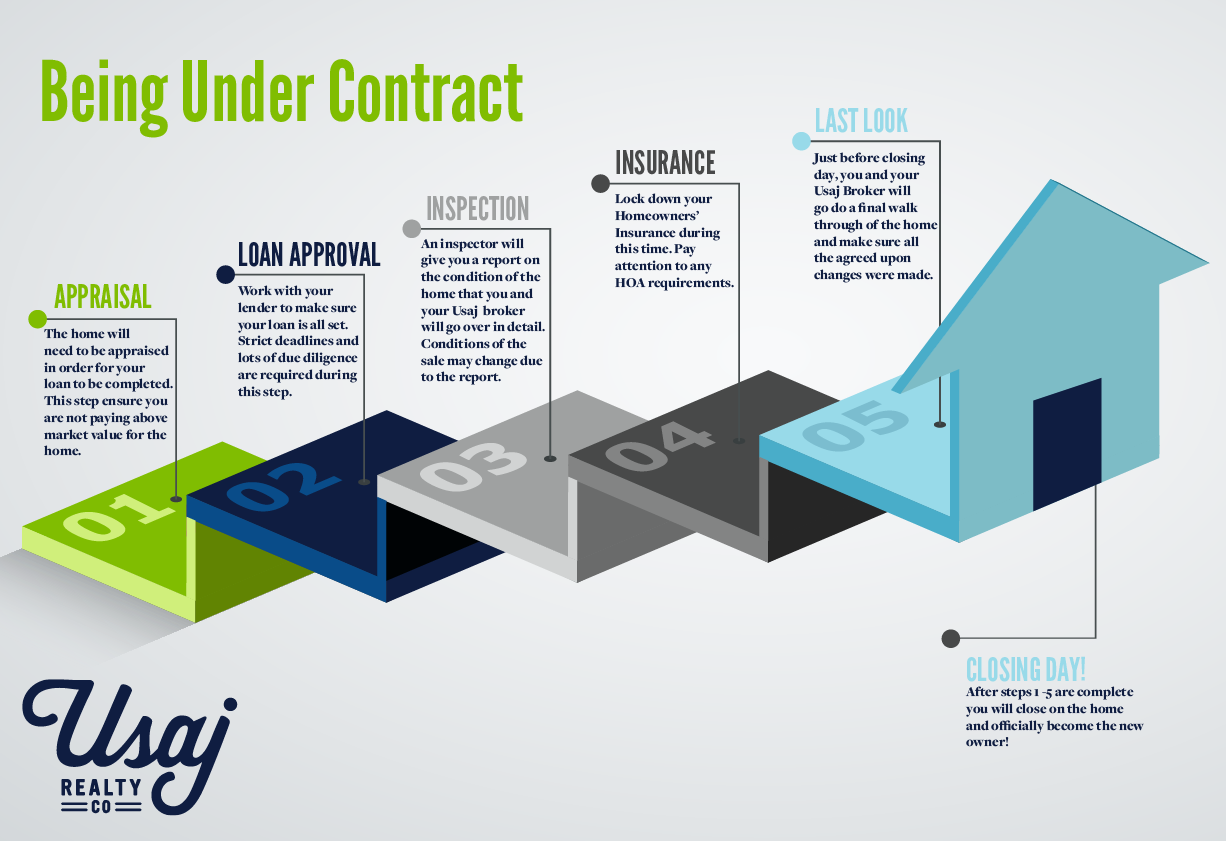

Here are a few of the steps that must be taken once you’re under contract:

Appraisal of the Property

Whether someone is buying or selling a home, having the right square footage for the listing and an accurate value of the property matters. This is why a home appraisal is a necessary plank in the road to closing. As a buyer, you need to know the exact valuation of the home based on its location, the structure and other features. The appraisal impacts the amount of money you can borrow and also the tax assessment you pay each year. You must be comfortable with the appraisal and your lender must feel confident that the amount of money being loaned to you is indicative of the value of the home.

Be aware there are some situations where the appraisal price comes in lower than the agreed upon price. This is especially true in a fast-paced sellers’ market (like the Denver area) where appraisals can’t keep up with average and median sales prices that keep rising. This appraisal gap is the difference between the appraisal and the contract price. To cover the difference, the home buyer agrees to provide cash to cover that gap.

Loan Approval

Unless the purchase of your new home is a cash settlement, you’ll have to get a loan. It’s one thing to be pre-approved, it’s another to formally apply for the loan. Your designated lender will help you with the necessary steps but be prepared to provide a bevy of financial documents. You can’t have enough patience during this part of the process. Keep in mind, the loan approval must be obtained by a specified date so make sure you’ve done your homework ahead of time. This is usually the last piece of the closing process but it is the most important. Always remember to keep the lines of communication open between you and your lender, and respond promptly to any requests for additional paperwork and forms. Although there is a strict timeline, keep in mind there can be extensions on the closing date so don’t fret if the loan approval gets bogged down.

Home Inspection

This critical part of the home buying experience can often make or break the deal, and tends to create anxiety on both sides of the aisle. Recommended for anyone serious about a home purchase, a home inspection is usually a two- to four-hour examination which reveals the inner workings of the house. It may provide additional facts that leads to negotiation on the final price. Based on the findings, the potential buyer can go back to the seller and ask for concessions on the price or ask that certain items be fixed prior to closing. Home inspection costs can range from $250 for some town homes, and up to $600 and more for a single-family home (depending on the square footage). There are ancillary services that can be added on as well such as radon and mold testing, and sewer scope inspection. There can also be an additional fee if the structure is over 50 years old as these home inspections can take longer.

Obtaining Property Insurance

It’s no surprise that obtaining homeowners’ insurance is a requirement of mortgage lenders when going through the home buying process. What may be surprising is the amount of detail that goes into adequately covering your home. It’s important to make sure you have adequate coverage on your home in the event of any property damage. It is estimated one in 15 insured homes will have a claim and it’s imperative to know what your policy includes.

Condo living is often the choice of first time home buyers. Make sure you have dwelling, personal property and personal liability coverage since the exterior of the building is insured by the condo association.

Bundling your homeowners’ insurance with an automobile policy can provide significant savings. Also, many companies provide discounts if you have a clean claims history, and a security system, smoke alarms and other safety features. Furthermore, it’s always a good idea to shop around for insurance each year before your policy renews as there can be dramatic savings year-to-year.

Title Search

Before a home can be transferred to a new owner, the title of the property must be clear. As a result, a title “search” must be conducted to prove there are no outstanding liens or claims against the property. This search is usually performed by a title company or lawyer representing the buyer. The process involves looking at records at the county level as well as taxing entities that would indicate any outstanding bills, legal proceedings or other issues. A title search can take a few hours to a few weeks to complete. During this process, title insurance is issued to both the buyer and lender to protect the parties if someone challenges your title to the property.

If there are problems with the title, the seller must rectify the situation and clear the title. Lenders will not approve a loan until the title is completely clear.

Transfer Utilities

A few days before closing, arrangements should be made to transfer the home’s utilities over to the buyer. This is usually a straight forward request and the utility costs will be prorated based on the date of closing.

Final Walk-Through

This is a very important final step to make sure that the home has been cleaned adequately, that nothing on the property has been damaged and there are no surprises before the home is transferred to the new owner. Be diligent about following through with this step to make the closing process an enjoyable one.

Closing Day!

The day has finally come to sign all the documents that transfers the ownership of the property to the buyer. This usually takes several hours to complete so set aside half a day to complete the process. There may be a number of people in attendance at the closing including the home seller and their agent, title company representatives, lawyers, a closing agent and the buyer, and sometimes a lender representative. It’s not advised to close on the final day of the month in the event there are any last minute problems. There may be increased closing costs if the transaction goes into the next month.

(Editor’s note: This blog was originally published in February of 2018. It has been edited and updated to provide current information).