Records continue to break as hyperactive buyer demand rages on

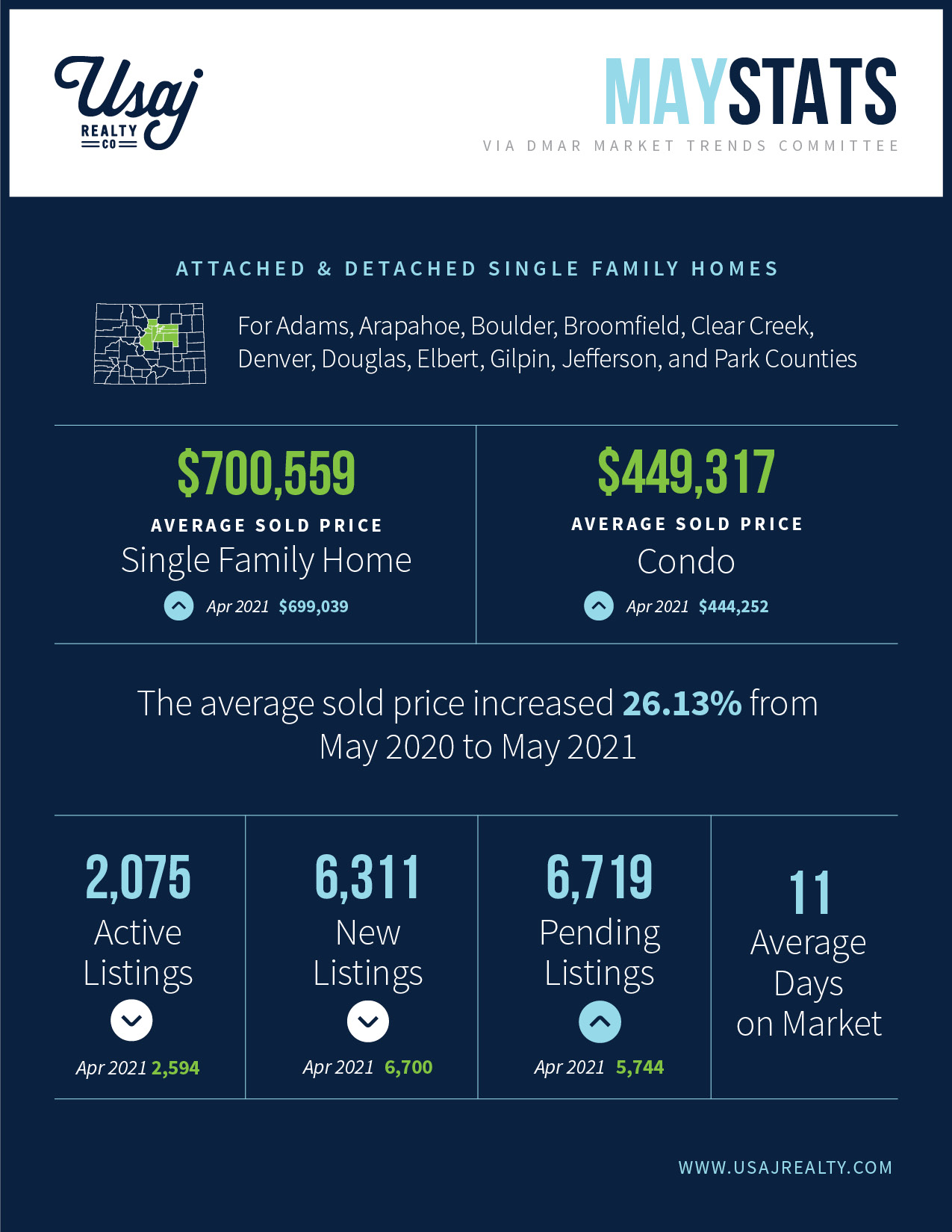

On average, Denver metro homes are selling in just 11 days, down 57 percent from last year and home prices continue to appreciate at a breakneck pace. Denver leads the nation in homebuyer traffic with an average of 25 showings per listing for the 3rd consecutive month in May 2021 (ShowingTime)

According to DMAR, “Interest rates continue to be relatively low and consistent. Listings continue to slowly hit the market, while buyers continue to gobble up properties as soon as they do. With the hyperactive buyer demand and low inventory, records will continue to be broken in this hot market.”

A quick look at what happened in May:

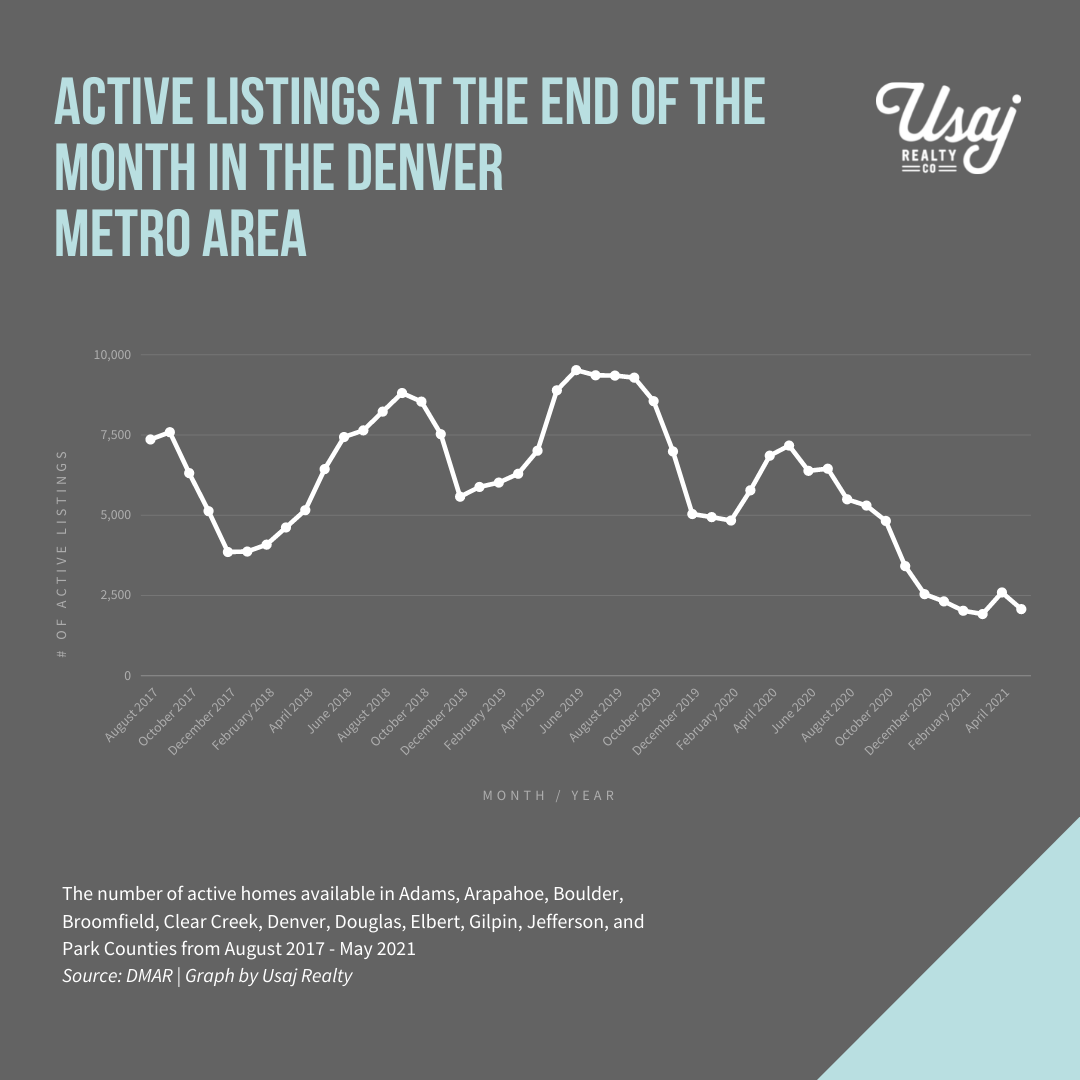

- Denver metro’s active listings available at the end of the month declined by 71% over last year

- The May median sale price was $540,000, up 22.81% compared to last year

- The typical home spent 11 days on the market in May, 12 days less than the same time last year

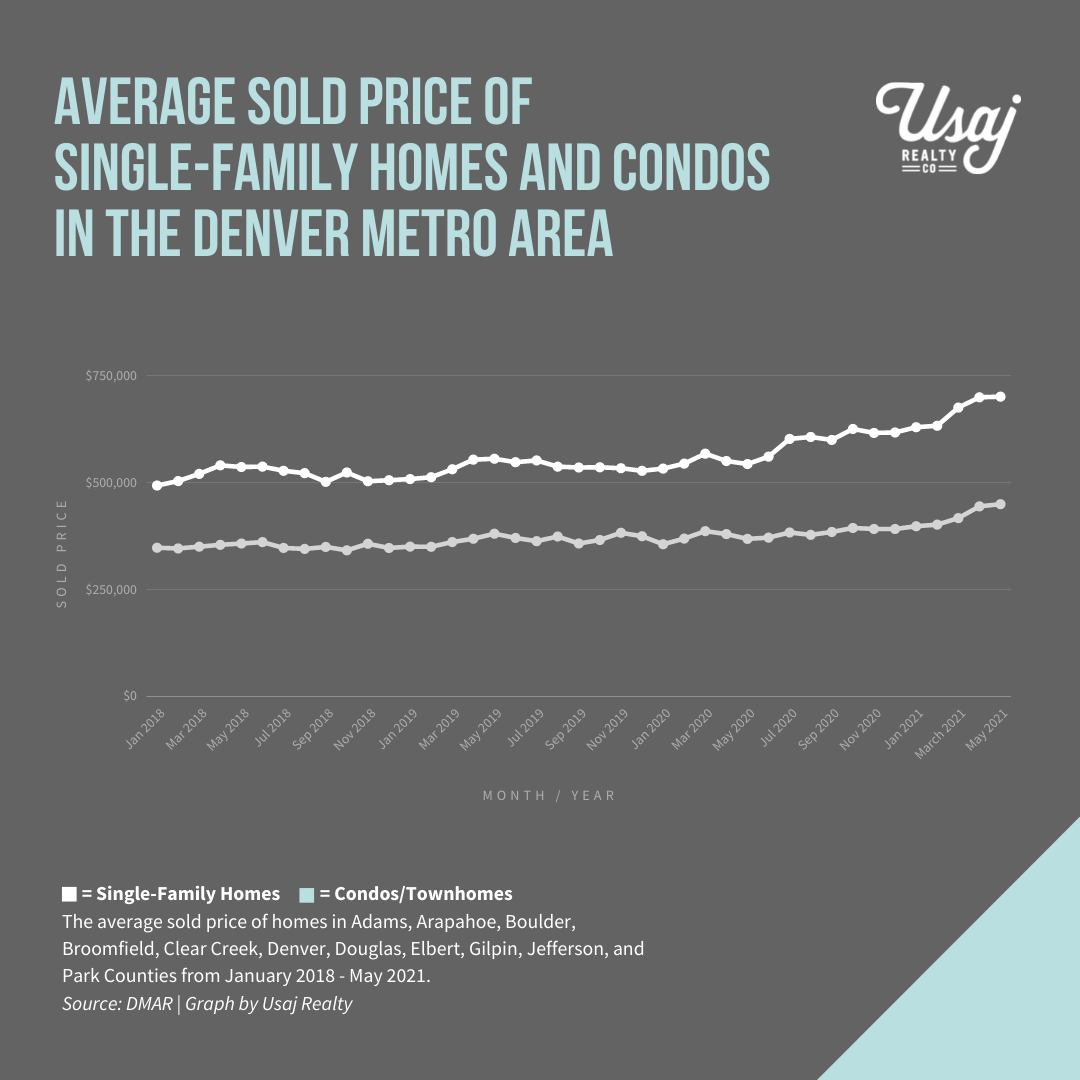

- The average price of a single-family detached home is currently $700,559, an increase of $157,487 then the same period a year ago

Some key market indicators to watch:

- New construction: Housing starts totaled 1.4 million last year, and some anticipate that we will see 1.5 million in 2021. Some builders are seeing waiting lists one to two years long (Builder).

- Construction costs continue to rise: Lumber prices have skyrocketed more than 300% since April 2020 (National Association of Home Builders).

- Employment numbers stalling for now: The U.S. Bureau of Labor numbers for last month show only 266,000 new nonfarm payroll employees added in April, down from 770,000 in March and 536,000 in February (Builder).

- The economy and inflation: Based on the Consumer Price Index, core inflation has risen 3 percent year-over-year and 0.9% month over month (Builder).

- Pandemic-related moratoriums on foreclosures and evictions are set to expire June 30: Some lenders plan to start resuming foreclosures in July. Around 2.1 million homeowners are still in mortgage forbearance (Mortgage Bankers Association). As of April, about 1.8 million households who aren’t in forbearance were 90 days delinquent on their loan (Black Knight).

- Changes in mortgage rates: Predictions vary from source to source on what rates are going to do. Experts expect us to be somewhere near 3.5 by the end of 2021 and close to 4 percent by the end of 2022. “Rising rates are expected to have a large impact on the future of housing prices, as well as the ability for potential buyers to afford a home,” (Builder).

May’s Numbers Over the Years:

| Avg. Days on Market | Avg. Sold Price: Single Family Home | Avg. Sold Price: Condo | # of New Listings | # of Homes Sold | # of Homes Pending | Avg. Sold Price Change YOY | |

| May 2016 | 30 | $456,018 | $300,348 | 6,788 | 4,861 | 5,857 | + 9.60% |

| May 2017 | 29 | $490,700 | $317,082 | 7,224 | 5,320 | 5,808 | +9.83 % |

| May 2018 | 18 | $540,624 | $356,337 | 7,748 | 5,235 | 6,178 | + 11.37 % |

| May 2019 | 24 | $555,482 | $380,363 | 8,789 | 5,551 | 6,470 | + 3.36 % |

| May 2020 | 23 | $543,072 | $368,241 | 7,312 | 3,152 | 6,809 | – 1.31 % |

| May 2021 | 11 | $700,559 | $449,317 | 6,311 | 5,322 | 6,719 | + 26.13 % |

Source: DMAR

Average Interest Rates by Year in Denver

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| Average Interest Rate | 5 % | 4.7 % | 4.4 % | 3.6 % | 4 % | 4.2 % | 3.8 % | 3.7 % | 4 % | 4.6 % | 3.9 % | 3.1 % |

Data courtesy of Megan Aller | First American Title

During these unprecedented times, Usaj Realty would love to carefully assist you with finding your next place to call home, or selling your current property. Our acumen, attention to the market, and negotiation skills will all go to work in order to advocate for your goals. Email us at info@usajrealty.com or call 720.398.2999. We measure our success by the happiness of our clients!

Headlines: What’s Happening in Colorado

The End Of The Pandemic Is In Sight. What Does That Mean For Colorado’s Housing Crisis?

“Coloradans typically make about $10,000 more than the rest of the nation per household, but homes are on average less affordable. The price of a home is about five times higher than household incomes in Colorado, whereas around the country, it’s closer to four times higher, said Michael Neal, a senior research associate in the Housing Finance Policy Center at the Urban Institute.”

Denver’s real estate market breaks 16 records in April 2021

“The Denver Metro Association of Realtors market trends report shows 16 sales related records were broken last month. One of the records is the average price of homes being sold.

In April, single family homes sold for an average of $623,825. The previous record was in March 2021 of $587,484.”

– Fox 31

Lumber Price Surge Drives Up Colorado Construction Costs

“A nationwide surge in lumber costs is affecting home buyers and homeowners in Colorado. Ali Wolf with the housing market research firm Zonda says lumber prices are up 250% compared to a year ago, driving up construction costs.”

What homebuyers are up against in the Denver market despite inventory boost

“And for the first time, the median price of a Colorado detached home hit over $500,000 in April, according to the latest figures from CAR. In Denver County, single-family homes hit a median price of $565,000, according to April figures from CAR.”

Headlines: What’s Happening Nationally

Report for May 2021:

Read Denver Metro Association of Realtor’s full report on last month’s Real Estate trends and statistics in Denver here.

And as always, please let us know if you have any questions!

Whether buying or selling, Usaj Realty is dedicated to helping you stay competitive. Your Usaj Realty broker will communicate effectively, learn your goals like the back of their hand, and work closely with you to negotiate the best terms possible, and expertly manage your transaction from start to finish, ensuring peace of mind.

Email us at info@usajrealty.com or call 720.398.2999.