Denver Housing Market Continues to Intensify

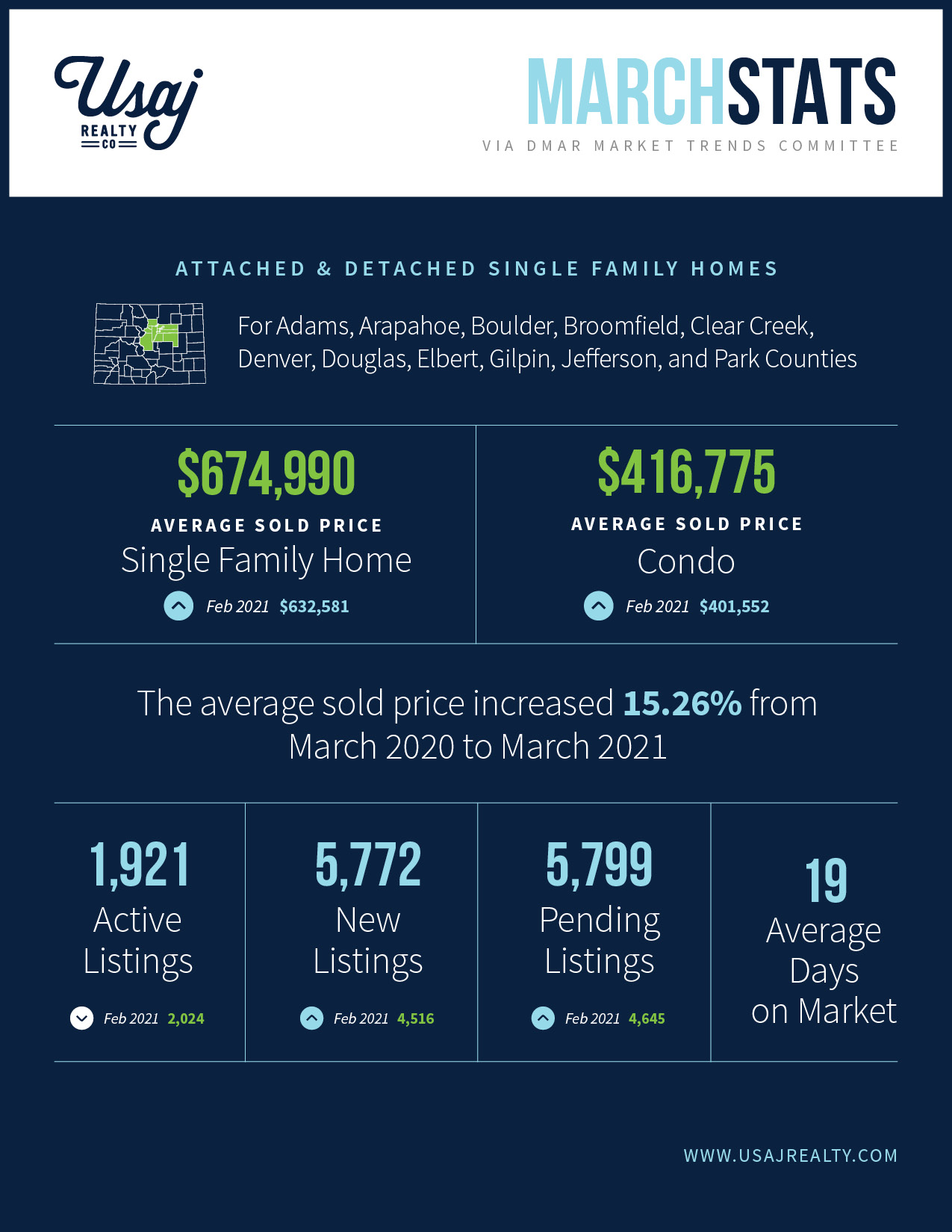

According to DMAR’s latest report, Denver metro saw 4,889 homes close in March 2021, 5,799 go under contract, and 5,722 new listings hit the market. March 2021 ended with LESS THAN 2,000 active homes for sale. This signifies a tight summer housing market ahead.

The Denver market has never seen fewer than 2,000 homes for sale. Since 1990, our average year end active inventory count was 12,000. After 2011, it was 6,000. When you consider there are 3.3 million people living in Denver Metro occupying 1.4 million housing units, saying we are low in inventory is an understatement (The Rueth Team).

Unlimited appraisal gaps. Unlimited escalation clauses. Words that were not in Denver Realtors’ vocabulary 3 months ago are the new norm as homes face a torrential cluster of competition within hours and days of hitting the market. A quick look at what happened in March 2021:

- Denver metro’s inventory declined by 66.74% over last year

- Newly listed homes on the market declined by 14%

- The March median sale price was $500,000, up 12.36% compared to last year

- The typical home spent 19 days on the market in March, 10 days less than the same time last year

- The average price of a single family detached home is currently $674,990, an increase of more than $40,000 from February 2021 and $107,600 higher than the same period a year ago

“Theoretically, this month’s report shows that if a buyer waited just one month to buy a $500,000 property from the end of February to the end of March, they would have had to pay $35,000 more for that property.” – DMAR

If you are currently buying or deciding to buy and want to avoid a multiple offer situation, check out homes that have not sold on the first 2 weekends of being on the market. Your Realtor can set you up on automatic searches for these listings, and in the meantime you can browse homes that have been on the marketing 30-60 days at the button below:

{{cta(‘7fe43766-154a-4dcf-a75c-7c5454797c89′,’justifycenter’)}}

Why Buying Real Estate Today is Still a Great Investment

- Denver’s population is continuing to grow: Denver has seen more than 17% population growth since 2010 (DBJ).

- The appreciation and equity growth in Denver is one of the highest in the nation: Homeowners who purchased 10 years ago in the Denver-Aurora-Lakewood area gained an average of $325K in home equity gain, putting us at #11 in the nation for wealth accumulation over the past 10 years (Realtor.com).

- Employment continues to grow: Denver has seen more than 25% employment growth since 2010 (DBJ).

- Compared to nationwide statistics, Colorado is more popular as a work from home destination with 46 percent of the population reporting that they telework compared to only 35 percent of adults nationwide.

- It’s the strongest seller’s market we’ve ever seen and we won’t be anything close to a buyer’s market anytime soon: “As interest rates start to trickle up, prices continue to rise, and inventory continues to shrink, other consistent questions become whether the market is in a bubble and if now is a good time to buy? If you use supply and demand as a metric for the ‘bubble’ question, it would be difficult to think that we are in one.” – DMAR

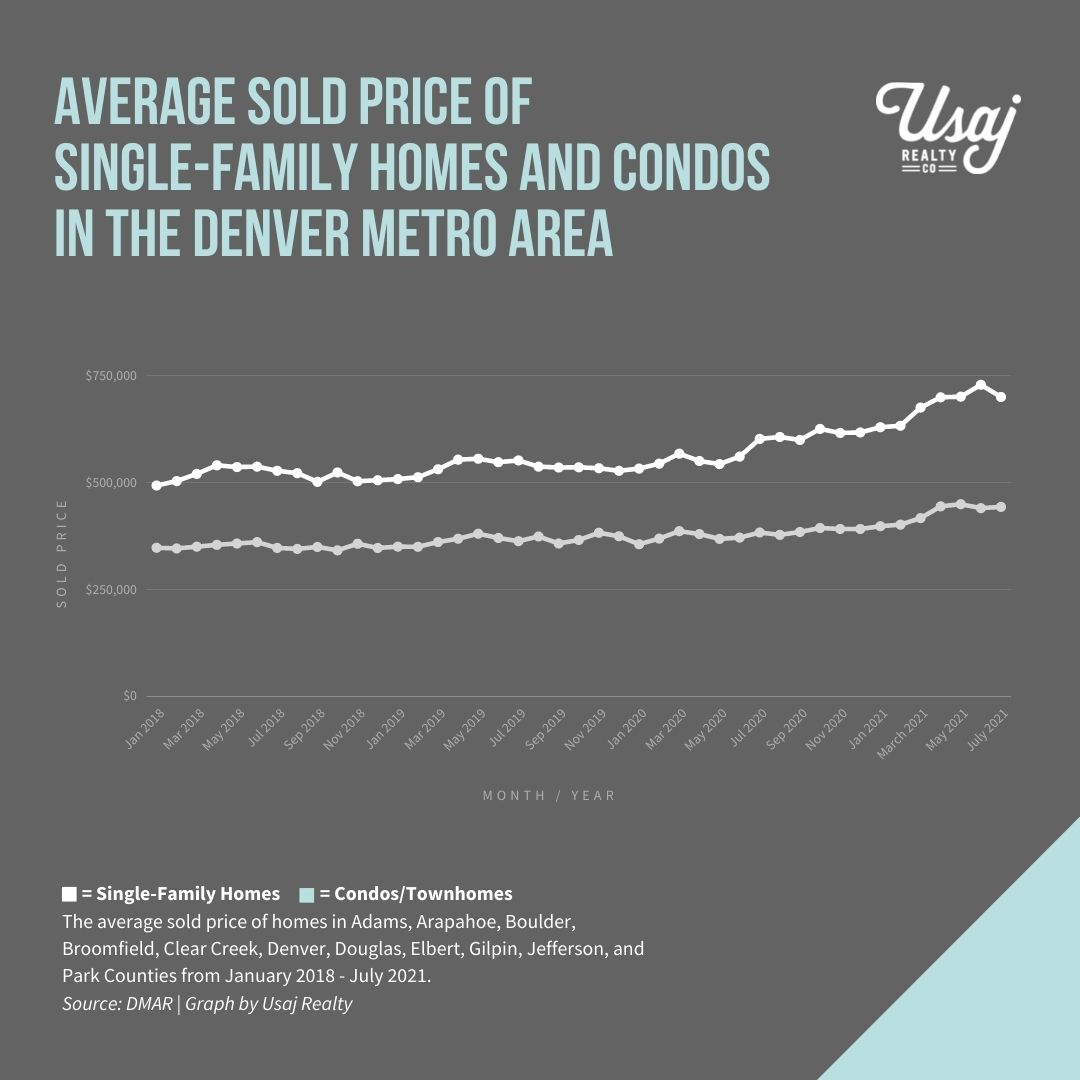

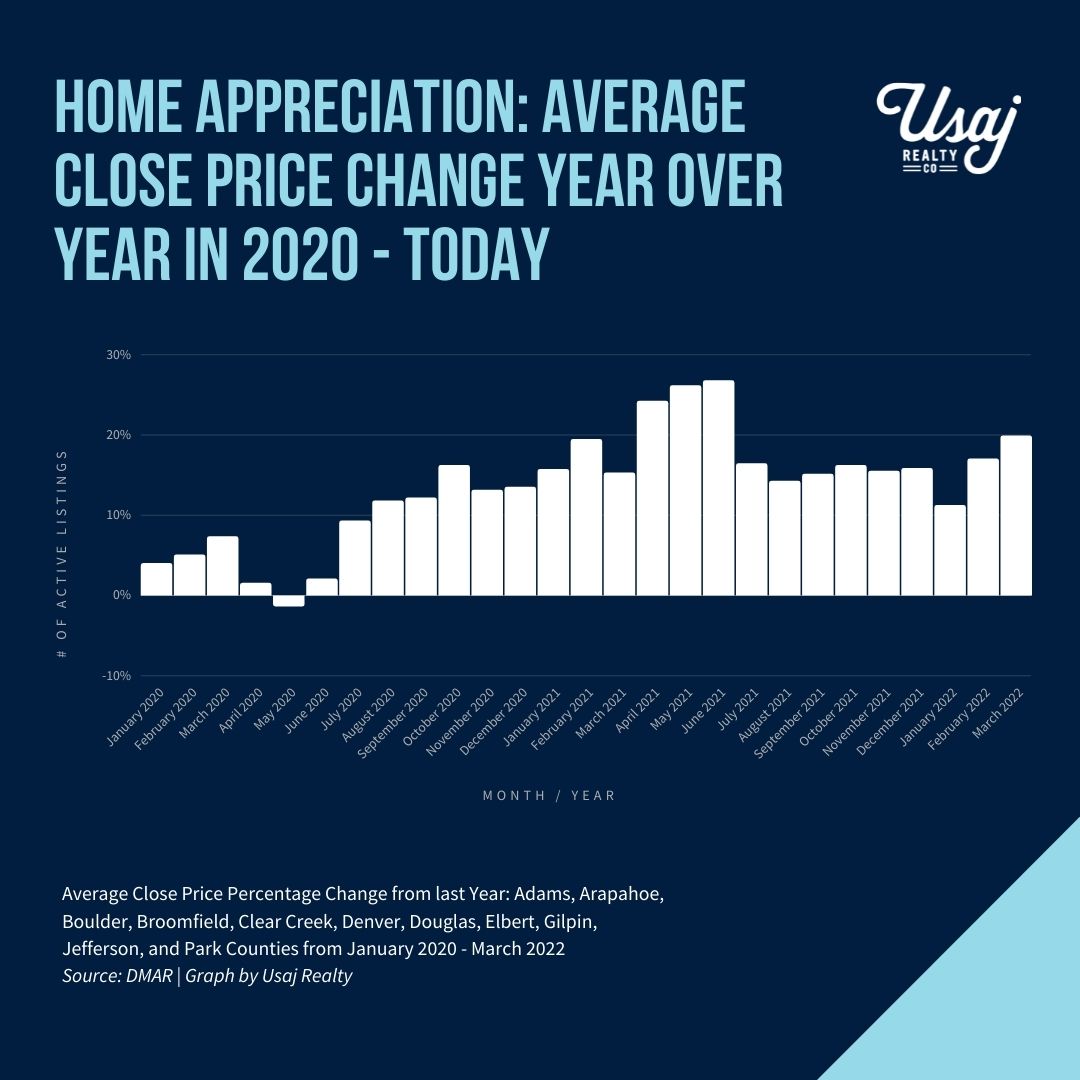

March’s Numbers Over the Years:

| Avg. Days on Market | Avg. Sold Price: Single Family Home | Avg. Sold Price: Condo | # of New Listings | # of Homes Sold | # of Homes Pending | Avg. Sold Price Change YOY | |

| Mar. 2017 | 39 | $468,889 | $317,402 | 6,810 | 4,347 | 5,194 | + 8.82 % |

| Mar. 2018 | 44 | $522,277 | $351,044 | 6,335 | 4,213 | 5,674 | + 10.9 % |

| Mar. 2019 | 31 | $530,897 | $360,875 | 6,197 | 4,162 | 5,660 | + 1.79 % |

| Mar. 2020 | 29 | $567,382 | $386,344 | 6,663 | 4,296 | 4,992 | + 7.31 % |

| Mar. 2021 | 19 | $674,990 | $416,775 | 5,772 | 4,889 | 5,799 | + 15.26 % |

Source: DMAR

During these unprecedented times, Usaj Realty would love to carefully assist you with finding your next place to call home, or selling your current property. Our acumen, attention to the market and negotiation skills will all go to work in order to advocate for your goals. Email us at info@usajrealty.com or call 720.398.2999. We measure our success by the happiness of our clients!

{{cta(‘ccccf9f5-79a6-4659-95ec-27051dfac745’)}}

Headlines: What’s Happening in Colorado

Average Denver home price hits $674K, up $40K in a month

“Up, up and away — again. According to the just-released April market trends report from the Denver Metro Association of Realtors, the average price of a detached home in the Denver area currently sits at $674,990, an increase of more than $40,000 over last month and in excess of $100,000 above the same period a year ago.”

– Westword

Bill aims to give local governments authority to require affordable housing units

“Colorado’s legislature appears poised to pass a bill giving local governments power to require new rental housing developments to provide affordable housing units. If adopted, the bill would reverse a longstanding interpretation of the state’s rent control statute precluding such requirements, which are commonly known as “inclusionary housing ordinances.”

Denver homes are flying off the market 41% faster than last year

“Homes in the metro often have hundreds of 15-minute viewings and end up with more than 20 offers. That competitiveness triggers bidding wars that result in most buyers paying at least 10-15% over already sky-high asking prices.”

– Axios

Headlines: What’s Happening Nationally

Home listing prices reach all-time highs. But how much higher can they go?

“Nationally, the inventory of homes for sale in March decreased by 52.0% over the past year, a higher rate of decline compared to the 48.6% drop in February. This amounted to 534,000 fewer homes for sale on a typical day in March compared to the previous year. Newly listed homes, while still declining compared to the previous year, improved slightly compared to last month. ”

Average home sale price hits all-time record

“The median home sale price increased 16% year-over-year to $331,590 – an all-time high, per a report this week from Redfin. But that’s not stopping buyers from snatching up homes days after they’re listed.

During a four-week period ending March 21 and covering 400 metros, 58% of homes that went under contract had an accepted offer within the first two weeks on the market. And between March 14 and March 21, 61% of homes sold in that timeframe had been on the market two weeks or less, and 48% had sold in one week or less.

And offers are coming in well-above asking price, too. Nearly 40% of homes sold above their list price – another all-time high – and 15 percentage points higher year-over-year. The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, increased to 100.2%.

This is concerning for experts, though, many of whom believe home prices will remain high even after mortgage rates, inventory, and building material costs recover to pre-pandemic levels. Rates are already above 3% – after falling into the 2% range during the majority of 2020 – but construction companies are still struggling to keep up with insane lumber prices, stifling new builds.”

Why are there no houses to buy?

“The real critical issue that has plagued the housing market is supply,” according to CBS News Business Analyst Jill Schlesinger. “Down 30 percent for existing homes. When you have a ton of people coming into the market, and limited supply, numbers are higher. All that limited supply is exacerbated by the fact that some boomers didn’t want to list their homes in the middle of a pandemic and when you look at the price of new homes, that’s also rising. Not just because of the lack of supply, but when you look at the cost of materials, whether its crude oil used in paints, it could be copper used in the lines, all put together, prices are indeed higher and a lot higher for many would be buyers.”

Report for March 2021:

Read Denver Metro Association of Realtor’s full report on last month’s Real Estate trends and statistics in Denver here.

And as always, please let us know if you have any questions!

Whether buying or selling, Usaj Realty is dedicated to helping you stay competitive. Your Usaj Realty broker will communicate effectively, learn your goals like the back of their hand, and work closely with you to negotiate the best terms possible, and expertly manage your transaction from start to finish, ensuring peace of mind.

Email us at info@usajrealty.com or call 720.398.2999.