See below for our full report for December 2018 and please let us know if you have any questions. We email this market infographic report on the Denver Real Estate Market each month. To get on the email list, please reach out to marketing@usajrealty.com and request to be added

A Look at our Inventory

To put things in perspective, in November 2010 we had over 32,000 active listings. And Denver’s home inventory has been low—below 10,000 active listings—since late 2013.

The number of new homes that hit the market in December vs. November decreased by a steep 41.18 percent. Taking the holidays into consideration, this drop is not incredibly surprising nor irregular.

The supply of new homes is likely to remain tight in the coming year, with a low supply of lots, not enough labor, and rising building costs.

What to Watch For in 2019

Along with our inventory shortage, there are a few other numbers to keep an eye on in 2019. Affordability for buyers and renters alike is concerning, as is the stock market’s volatility.

However, loan applications are on the rise, which is a good sign that buyers are still willing to enter the market despite higher interest rates, rising home prices, and low supply. Commercial real estate and if businesses continue to bring their companies to Denver are two other indicators of the health of the market. Denver’s population and job growth continue to be high, both of which are good signs for the commercial real estate market and for its economy.

Key Takeaways for December 2018 via DMAR for Metro Denver

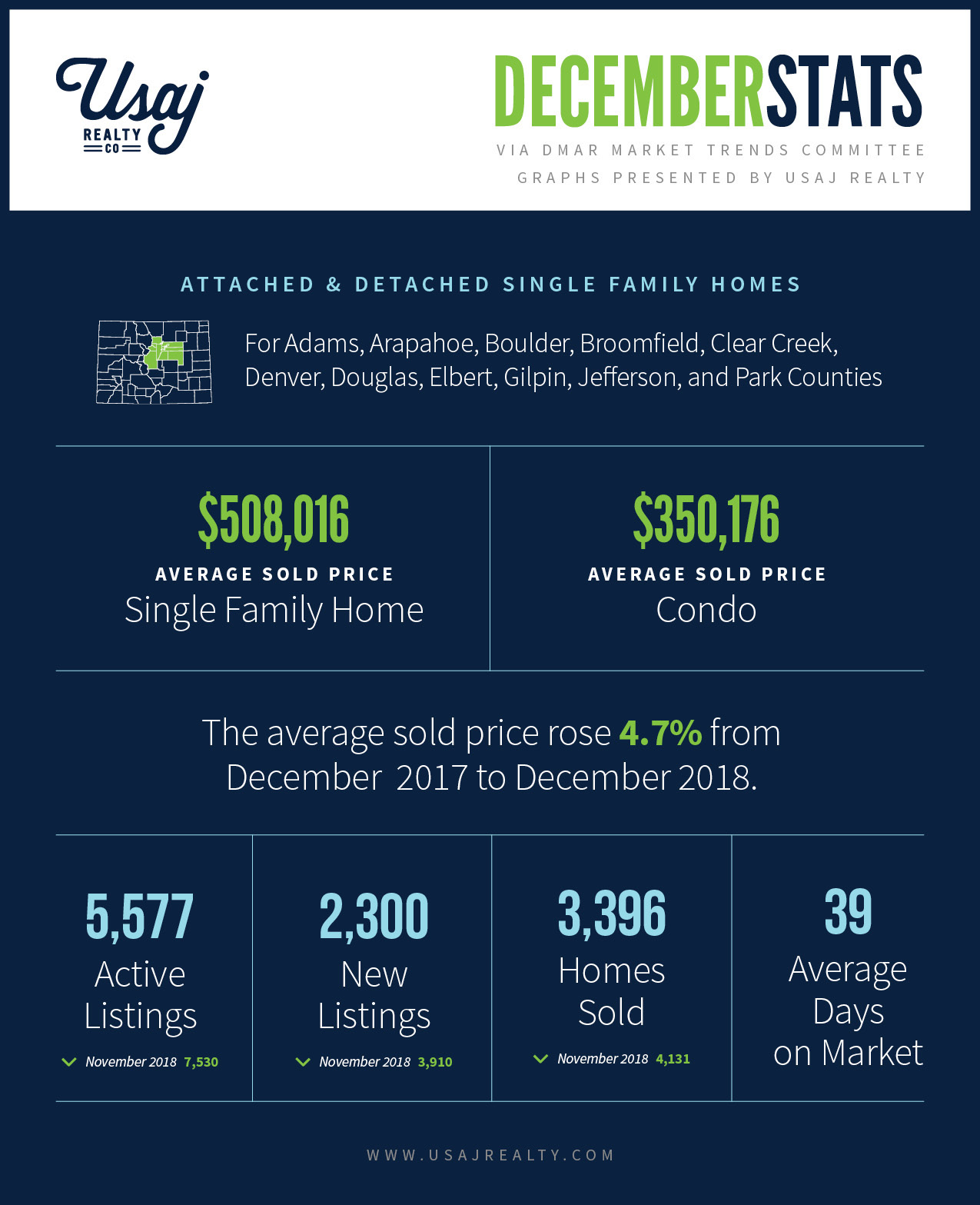

Stats below include data for Adams, Arapahoe, Boulder, Broomfield, Clear Creek, Denver, Douglas, Elbert, Gilpin, Jefferson, and Park Counties

- Active Inventory in December 2018: 5,577

- November 2018 Active Listings: 7,530

- October 2018 Active Listings: 8,539

- September 2018 Active Listings: 8,807

- August 2018 Active Listings: 8,228

- July 2018 Active Listings: 7,643

- June 2018 Active Listings: 7,436

- May 2018 Active Listings: 6,437

- April 2018 Active Listings: 5,160

- March 2018 Active Listings: 4,619

- February 2018 Active Listings: 4,084

- January 2018 Active Listings: 3,869

- December 2017 Active Listings: 3,854

- November 2017 Active Listing: 5,131

- October 2017 Active Listing: 6,312

- September 2017 Active Listings: 7,586

- August 2017 Active Listings: 7,360

- Median Sales Price for a condo in Denver metro in December 2018: $298,225

- November 2018: $299,450

- October 2018: $299,250

- September 2018: $301,625

- August 2018: $299,000

- July 2018: $300,000

- June 2018: $305,000

- May 2018: $306,331

- April 2018: $297,000

- March 2018: $295,000

- February 2018: $296,000

- January 2018: $285,000

- December 2017: $285,000

- November 2017: $272,000

- October 2017: $275,000

- September 2017: $268,000

- August 2017 $275,000

- July 2017: $270,100

- Median Sales Price a single-family residence in Denver metro in December 2018 was: $430,000

- November 2018: $427,000

- October 2018: $435,000

- September 2018: $428,000

- August 2018: $445,000

- July 2018: $450,000

- June 2018: $452,500

- May 2018: $450,000

- April 2018: $455,000

- March 2018: $440,875

- February 2018: $435,000

- January 2018 was $416,000

- December 2017: $415,000

- November 2017: $405,000

- October 2017: $415,000

- September 2017: $409,000

- August 2017: $410,000

- July 2017: $420,000

What’s Happening in Denver:

Is metro Denver’s hot streak in home prices at risk? Analysts disagree.

“Metro Denver has clocked some of the strongest home price gains in the country during this economic expansion, which if it survives to June will rank as the longest in U.S. history. But in the second half of this year, the housing market here and in other cities has cooled, with sales slumping and the inventory of unsold homes rising. And while annual price gains are still solid, the median price of homes sold continues to drop from the peaks reached this summer.” – Denver Post

Denver Metro Association of Realtors January Report

“Optimism remains high for the 2019 housing market in Denver. While interest rates are increasing, loan applications are on the rise. Buyers and sellers are eagerly making plans to enter the marketplace this year.” – DMAR

Colorado Gains 80,000 Residents; Growth Rate 7th in Nation

“The U.S. Census Bureau says Colorado grew by nearly 80,000 people between mid-2017 and mid-2018.

The Denver Post reported Monday that Colorado’s population grew by 1.4 percent in the 12 months ended July 1.

The Census Bureau says that’s the seventh-fastest growth rate in the country. Nevada and Idaho were tied for first with a 2.1 percent growth rate.” – U.S. News

Crane Watch: 2018 ends with more residential, industrial projects

“December ended with a new residential and industrial projects hitting the Crane Watch map.” – Denver Business Journal

No signs construction labor shortages are easing in Colorado

“About 85 percent of contractors describe hard time filling open jobs.” – Denver Post

What’s Happening Nationally:

Housing market signaled potential future downturn in 2018

U.S. House Price Index Report – 3Q 2018

“U.S. house prices rose 1.3 percent in the third quarter of 2018 according to the Federal Housing Finance Agency (FHFA) House Price Index (HPI). House prices rose 6.3 percent from the third quarter of 2017 to the third quarter of 2018. FHFA’s seasonally adjusted monthly index for September was up 0.2 percent from August.” – FHA

Home price appreciation is slowing down

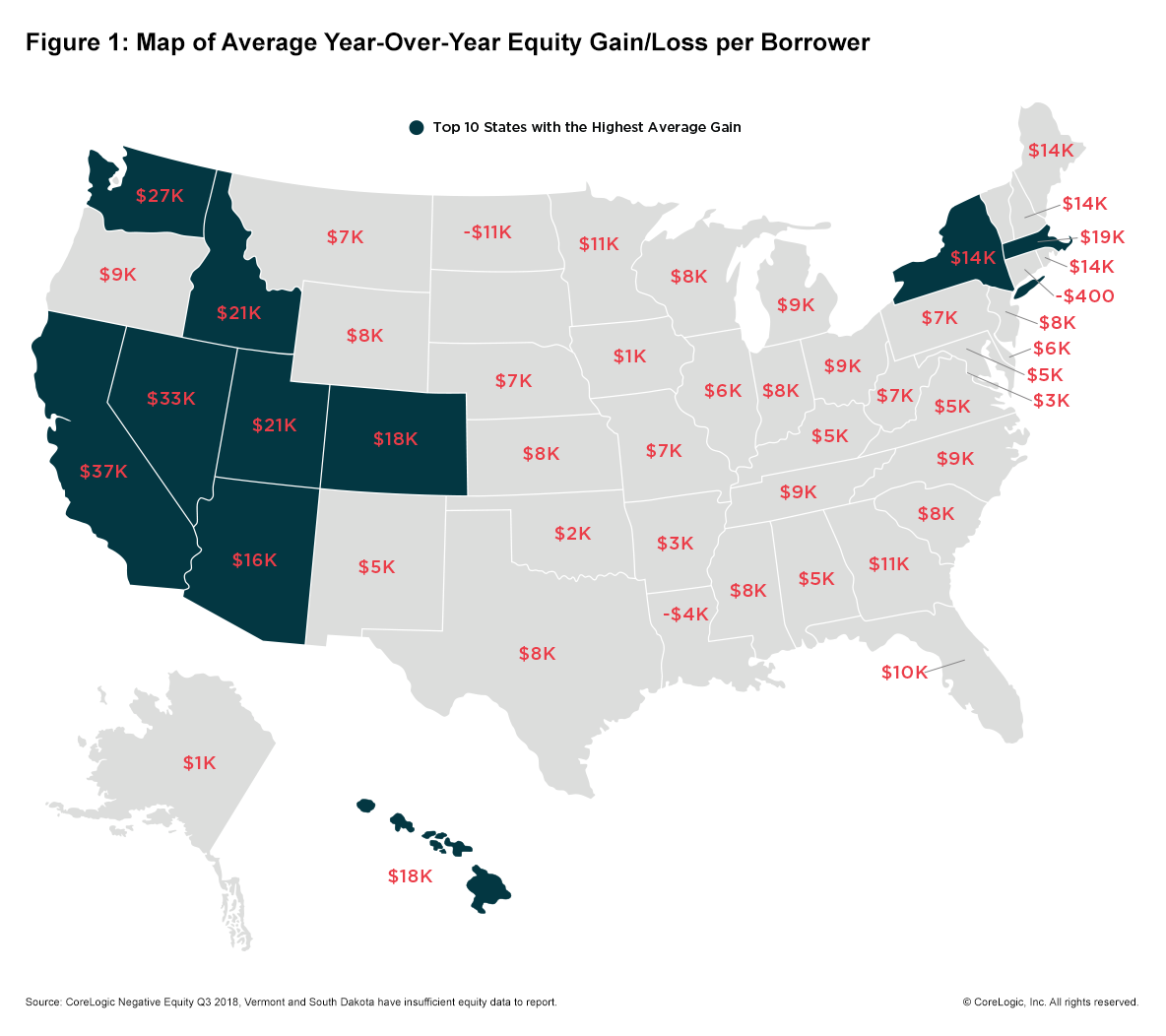

“Equity is still climbing, just not as fast as before. CoreLogic analyzed data on more than 50 million U.S. properties with a mortgage. Its report revealed that homeowners with mortgages (which account for 63% of all properties) saw their home equity increase 9.4% from last year.” – Housing Wire

Report for Metro Denver:

Read Denver Metro Association of Realtor’s full report on last month’s Real Estate trends and statistics in Denver here.

And as always, please let us know if you have any questions!