Denver Housing Market Update

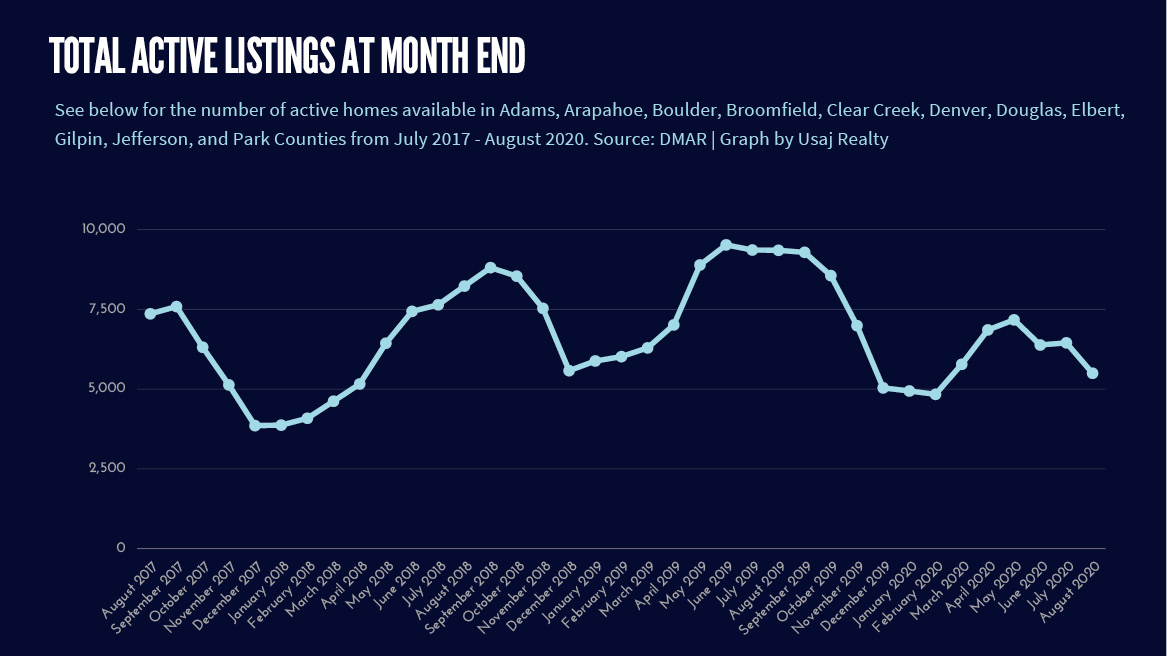

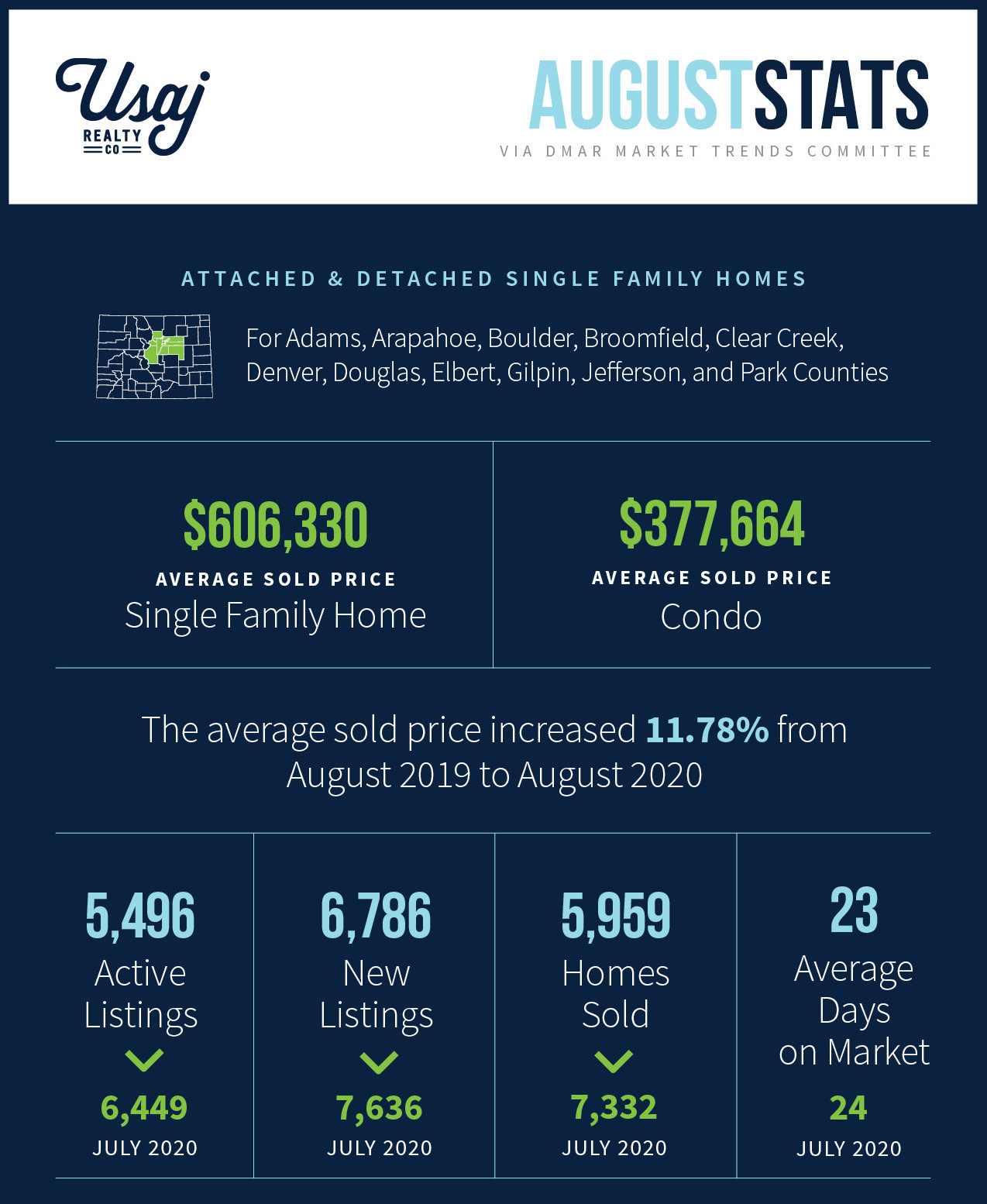

If we had to sum up the Denver housing market in just a few short words, we would say this: rising prices and extremely low inventory. 7,323 homes went under contract in August 2020, and only 6,786 new homes went for sale. We had 41.22 percent more homes for sale at the end of August 2019 than we did in August 2020.

One outcome of this reality is that bidding wars over single-family homes priced under $750,000 are becoming the norm yet again in the Denver area. The single-family housing market continues to benefit from side effects of the pandemic as high-density urban living with no space for spreading out has lost ground. According to CPR, “The lack of inventory and low interest rates is driving prices up while the economy shrinks and unemployment skyrockets due to the COVID-19 pandemic.”

The average price of a home in the Denver metro jumped to $542,784 in August, a 11.78 percent increase from August 2019.

Low inventory is also driving prices up. The average price of a home (detached or attached) in the Denver metro jumped to $542,784 in August, an 11.78 percent increase from August 2019. Demand for single family homes are the cause of this increase. The good news? According to DMAR, “pending contracts for all property types were up 7.79 percent month over month and 32.64 percent year over year” — meaning that the market is extremely active.

According to the report, it is a seller’s market for all price points except for attached homes that are priced over $1 million.

First 8 months of 2019

| Days on Market | Avg. Sold Price: Single Family Home | Avg. Sold Price: Condo | # of Homes Sold | # of Homes Pending | Avg. Sold Price Change YOY | |

| Jan. 2019 | 39 | $508,016 | $350,176 | 2,915 | 4,008 | + 2.89 % |

| Feb. 2019 | 39 | $512,312 | $349,801 | 3,468 | 4,443 | + 0.66 % |

| Mar. 2019 | 31 | $530,897 | $360,875 | 4,488 | 5,448 | + 1.79 % |

| Apr. 2019 | 28 | $553,371 | $368,565 | 5,205 | 6,470 | +1.5 % |

| May 2019 | 24 | $555,482 | $380,363 | 6,164 | 6,470 | +3.36 % |

| Jun. 2019 | 23 | $547,461 | $370,442 | 5,772 | 6,101 | +1.57 % |

| Jul. 2019 | 25 | $551,516 | $362,922 | 5,415 | 5,944 | +4.27 % |

| Aug. 2019 | 30 | $537,024 | $373,782 | 5,129 | 5,870 | +3.53 |

First 8 months of 2020

| Days on Market | Avg. Sold Price: Single Family Home | Avg. Sold Price: Condo/Townhome | # of Homes Sold | # of Homes Pending | Avg. Sold Price Change YOY | |

| Jan. 2020 | 45 | $532,494 | $355,754 | 3,324 | 4,923 | + 3.98 % |

| Feb. 2020 | 39 | $544,054 | $368,936 | 3,835 | 5,083 | + 5.04 % |

| Mar. 2020 | 29 | $567,382 | $386,344 | 4,296 | 4,992 | + 7.31% |

| Apr. 2020 | 20 | $550, 177 | $379,495 | 3,603 | 3,280 | + 1.52 % |

| May 2020 | 23 | $543,072 | $368,241 | 3,548 | 6,809 | – 1.31 % |

| Jun. 2020 | 24 | $560,435 | $371,172 | 6,179 | 7,381 | + 2.06 % |

| Jul. 2020 | 24 | $601,863 | $383,174 | 7,332 | 7,122 | + 9.27 % |

| Aug. 2020 | 23 | $606,330 | $377,664 | 5,959 | 7,323 | +11.78 % |

Source: DMAR

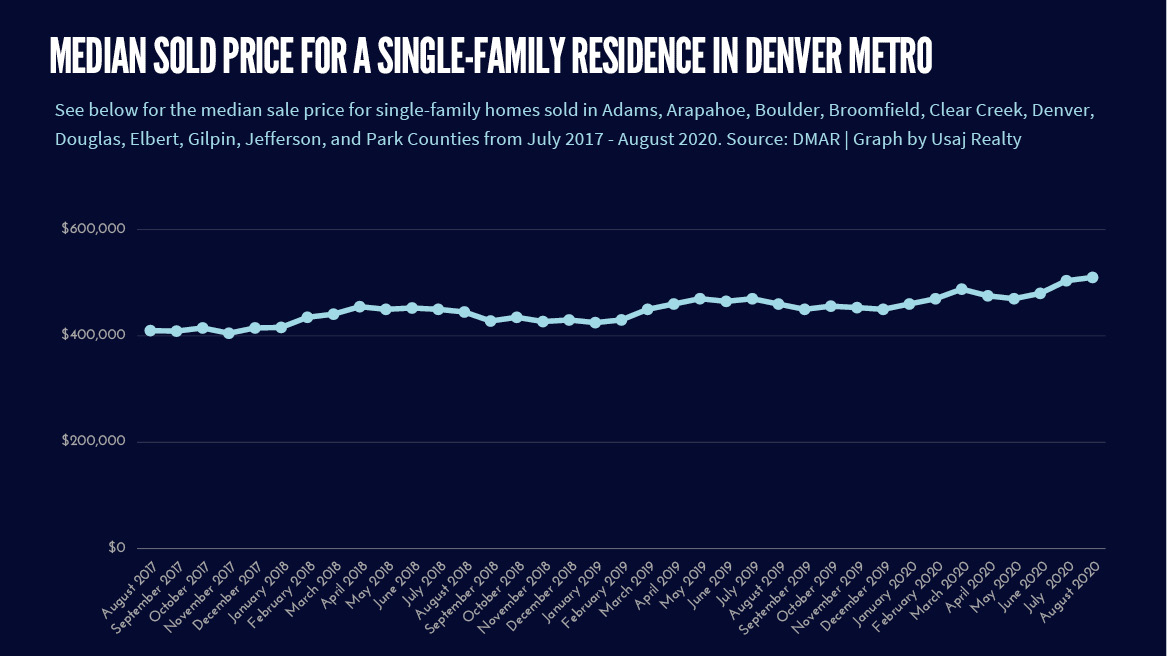

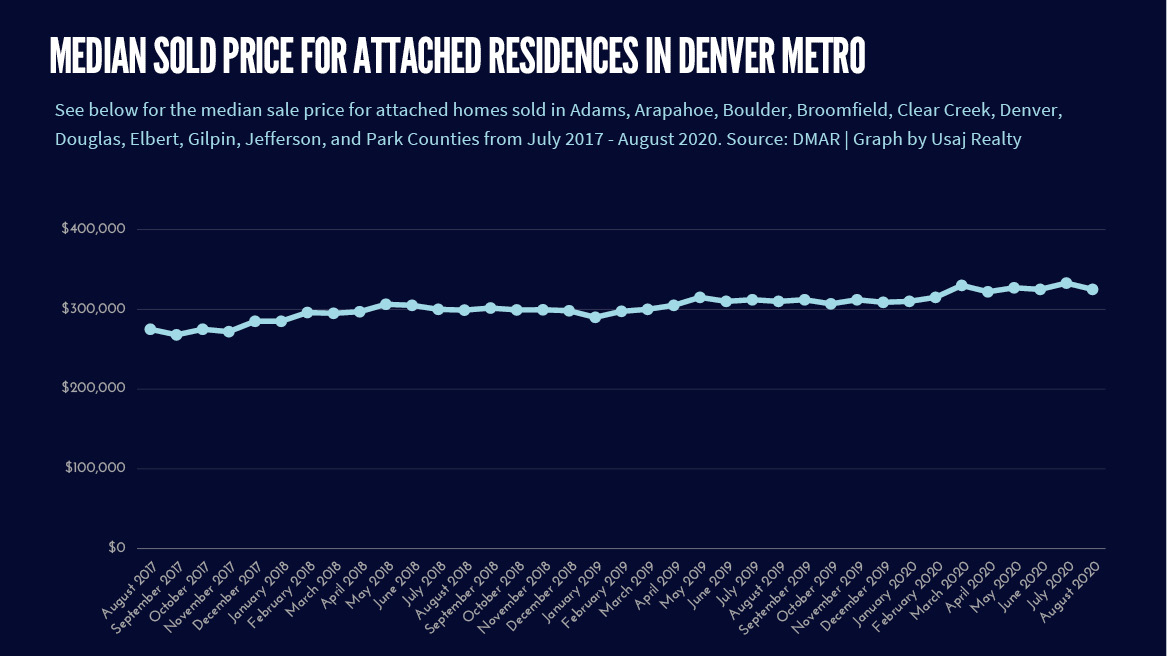

Housing Market | Sold Prices and Active Listings in Metro Denver:

Stats below include data for Adams, Arapahoe, Boulder, Broomfield, Clear Creek, Denver, Douglas, Elbert, Gilpin, Jefferson, and Park Counties

{{cta(‘306f76cc-bb61-4b78-84f6-7ea5feb5e301’)}}

Headlines: What’s Happening in Denver

Real Estate Prices In Metro Denver Are Climbing

“Homes sales in metro Denver surged in July as pent-up demand and a lack of choices pushed buyers to make a deal. A record 6,664 homes sold in July, surpassing the previous monthly high set in June 2017, according to the Denver Metro Association of Realtors. The average price rose to $601,863, a 7.68 percent increase from June, the association said in a report today.”

–CPR

‘Shrugging Off’ The Pandemic, Colorado’s Housing Market Broke Records This Summer

“Deals are increasing even as buyers face limited options. Active listings dropped more than 11 percent from June, according to the report and 42 percent from last year. The lack of inventory and low interest rates is driving prices up while the economy shrinks and unemployment skyrockets due to the COVID-19 pandemic.”

– CPR

Denver Home Prices Overvalued, Report Says

“For years, the Denver area housing market was so scorching that it seemed nothing could dial down the heat — and prices haven’t dropped thus far, despite the local impact of the global pandemic. But a new report contends that metro home prices are seriously overvalued and predicts that they’ll decline nearly 10 percent by the spring of 2021.”

– Westword

Expert Opinion: DMAR Market Trends

“As long as buyer demand continues to outpace supply, we will see prices go up. The average price for a detached home hit another record at $606,330. That is an increase of 5.56 percent year to date. Attached home sales weren’t doing quite as well as average August pricse were down month over month but still up 2.58 percent year to date.”

– DMAR

Headlines: What’s Happening Nationally

What Will The Pandemic’s Impact Be On The Real Estate Market?

“The pandemic has already caused a mini-exodus out of New York City, and with lower taxes, lower interest rates, and — for the wealthiest among us — higher earnings thanks to stock market gains and some helpful bailouts, the housing market is roaring outside of urban America.”

– Forbes

The 2020 housing market is now outperforming 2019

“NAR Chief Economist Lawrence Yun said he believes home sales will be slightly ahead of 2019 and then up even more in 2021, rising 8 percent year over year.”

– Inman

Home Prices Hit Record Highs. Is It a Bubble About to Burst?

“Reality check: If there is a current-day bubble, it bears little resemblance to the gigantic bubble created by subprime mortgages, which burst into the Great Recession. Then came the mass foreclosures, plummeting home values, and the scores of homeowners suddenly underwater on their mortgages.

This year’s sky-high prices are driven by a rush of buyers competing for a very limited supply of properties. More demand than supply equals higher prices.”

Report for August 2020:

Read Denver Metro Association of Realtor’s full report on last month’s Real Estate trends and statistics in Denver here.

And as always, please let us know if you have any questions!