Inventory is up 23% and prices are up 19% from last year

As interest rates surpassed 5 percent, Denver metro’s active listings available at the end of April increased by 44.26 percent over last month and 23.52 percent from last year (DMAR). We ended the month with 3,204 active homes on the market and saw 4,912 homes close. The median price of all home types in the Denver metro area is currently $624,950, an increase of 19.04 percent from the same period a year ago. Homes are selling on average in 8 days, 38.46 percent faster than this time last year than last year’s inventory.

So are we in a housing bubble?

Inflation is at its highest point in 40 years and this daily reality has home buyers concerned. If you want to buy or sell this year but are worried about what could happen to the market, it’s important to think about the following six signs that indicate we are not in a housing bubble:

- Foreclosures are at an all-time low. ATTOM Data recorded only 151,153 home foreclosure filings last year, the lowest number since it started recording in 2005. This means that homeowners are not being forced out of their homes due to inflation. The 2008 housing crash was a foreclosure crisis, and are we are nowhere close to seeing that happen again.

- Equity is at an all-time high: If prices were to drop (which is not expected), Americans would have lots of equity to protect themselves and could still sell their homes to pay off their mortgage debt. According to Business Insider, “the average mortgage borrower currently [owns] about $185,000 in tappable home equity — the amount of money a homeowner can access while retaining at least 20% equity in their homes.”

- Savings are at an all-time high: During the pandemic, U.S. households have collectively gained about $2.5 trillion in excess savings and more than half of U.S. states recorded their strongest-ever personal income growth just last year.

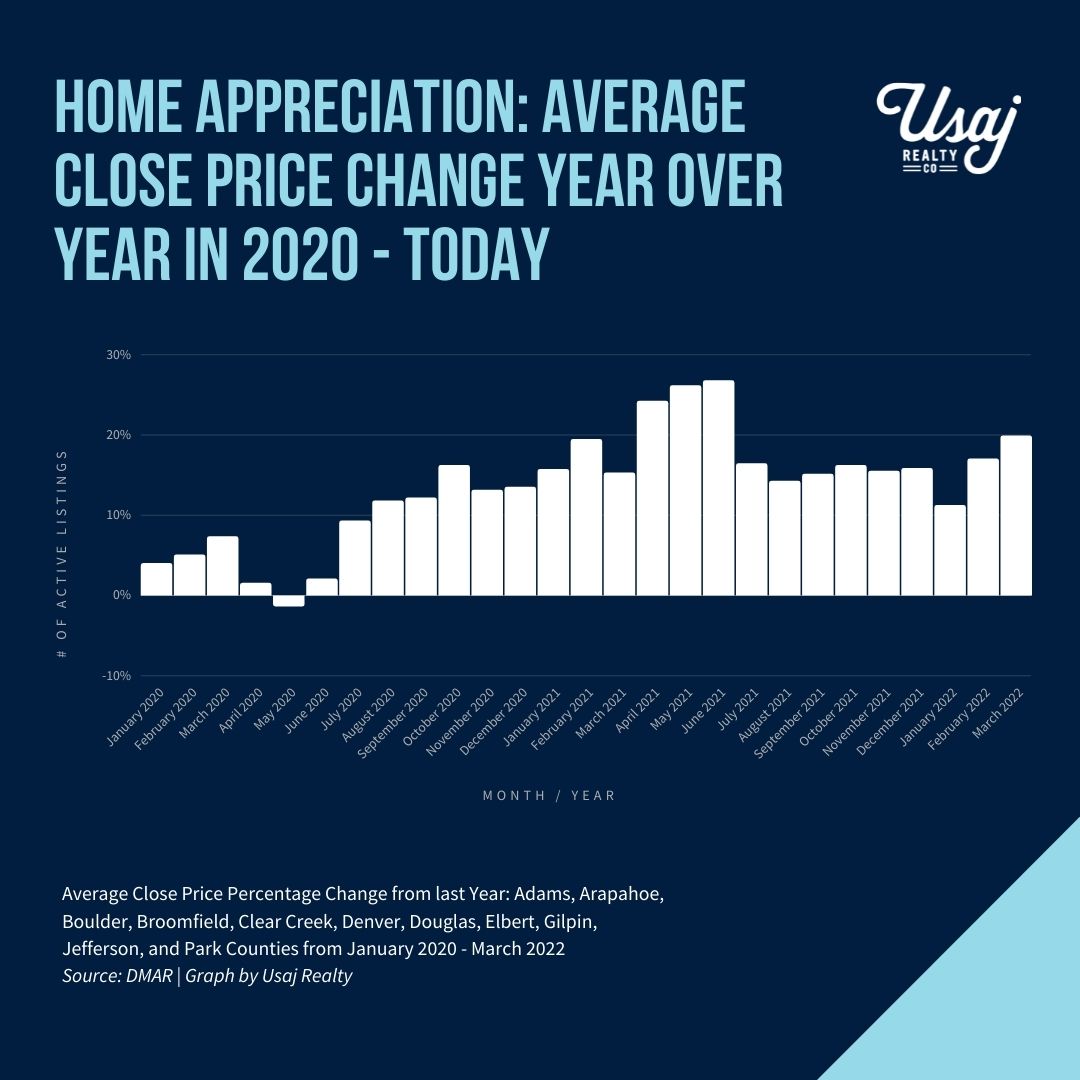

- Homes are expected to continue to appreciate, even if it’s no longer at the breakneck pace of 2021-2022’s numbers of 15+% each month. Fannie Mae recently forecast that U.S. home prices will rise 10.8% in 2022. And in April 2022 we still had a 19% gain from April 2021 for the median sale price of all homes.

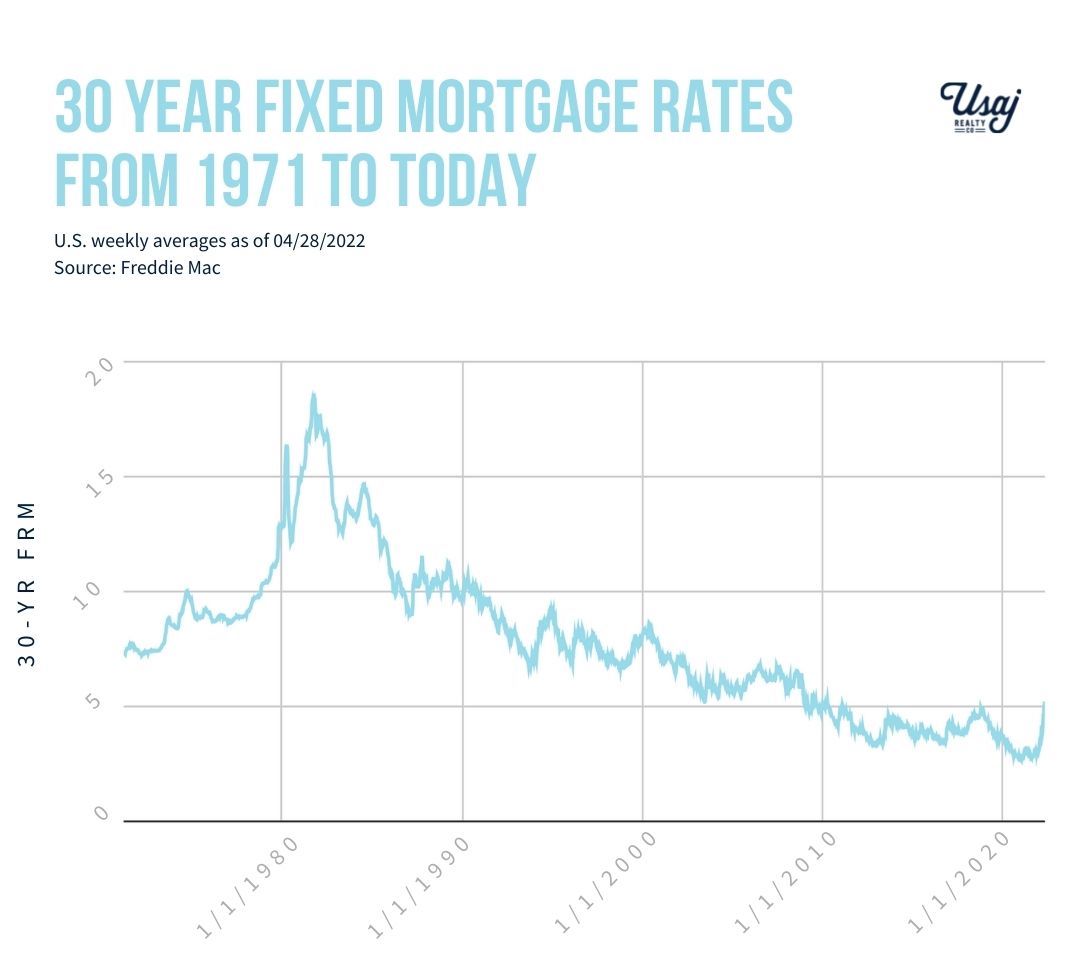

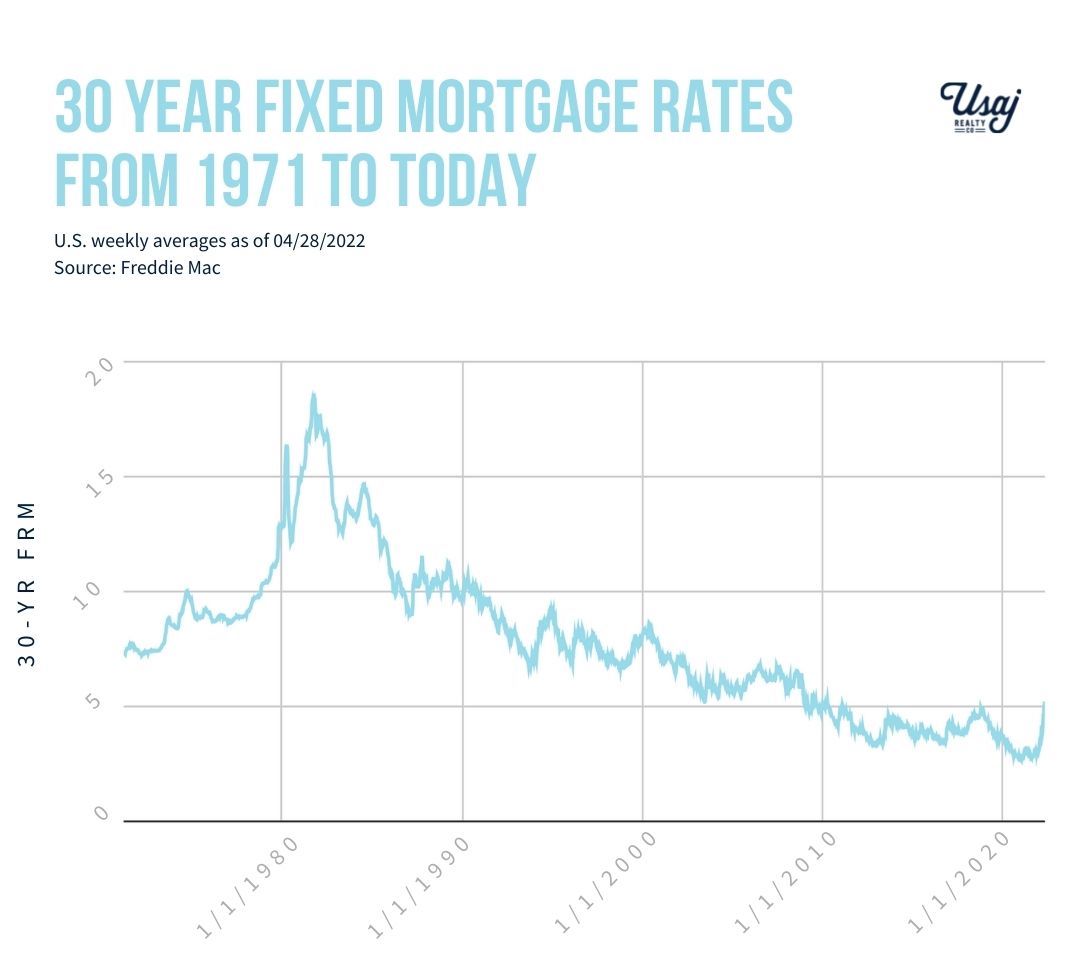

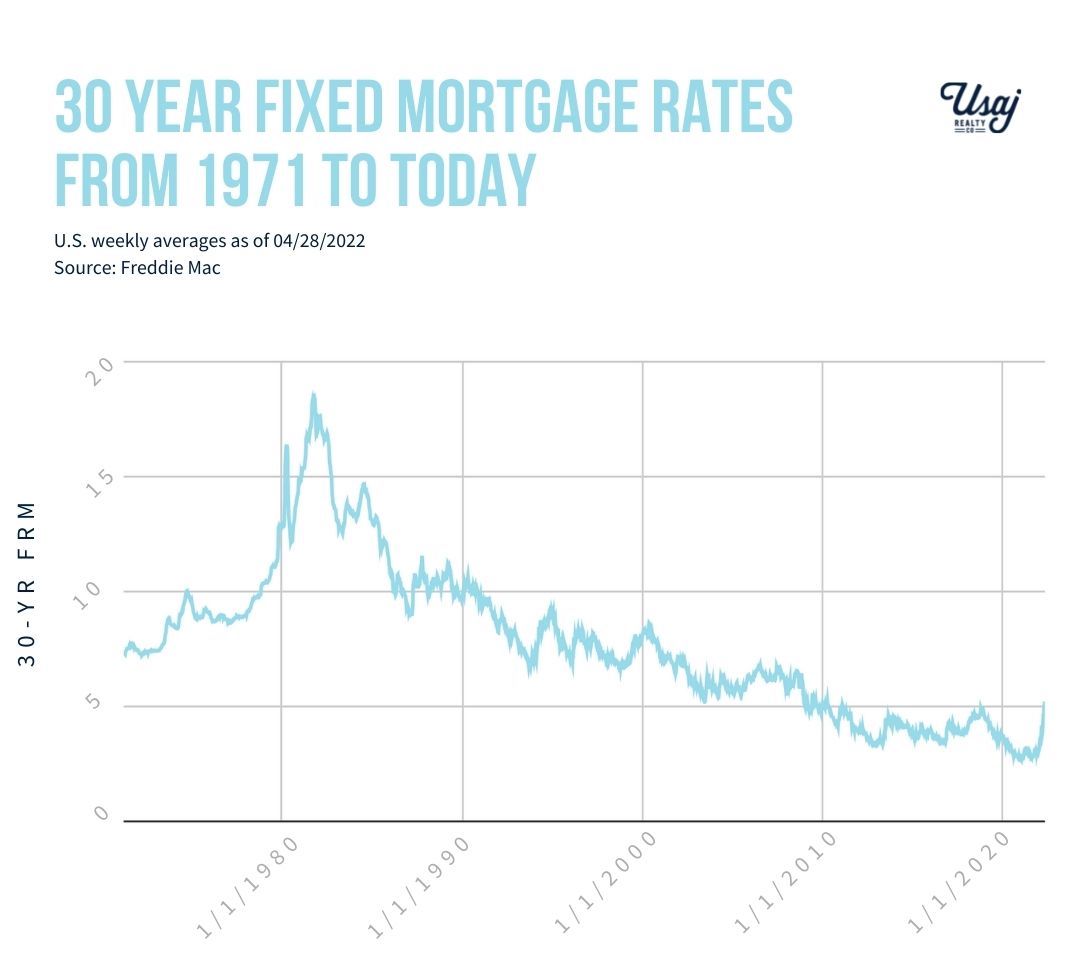

- Lending standards are much more strict today than they were before the 2008 crash. The Dodd-Frank Wall Street Reform and Consumer Protection Act has helped to prevent some of the predatory lending practices that spurred the subprime mortgage crisis. Borrowers have to go through larger hoops to qualify for a mortgage and bring more money into a down payment than in 2008. According to Money.com, “The median FICO for purchase loans is 40 points higher than the pre-housing crisis level of around 700.”

- Inventory levels are still not close to keeping up with demand: According to an article in the New York Times, the lack of home inventory will continue to keep home prices at lofty levels. “The problem is there are so few homes for sale that even a slower market is unlikely to create enough inventory to satisfy demand anytime soon. For years, the United States has suffered from a chronically undersupplied housing market. Homebuilding plunged after the Great Recession and remained at a recessionary pace long after the economy and job market had recovered. Even today, the pace of home building remains below the heights of the mid-2000s, before the 2008 financial crisis and housing market crash.”

After taking these factors into consideration, it seems more reasonable to think that inflation and rising rates will cause more of a slowdown in the market rather than a full-blown crash.

So what does this mean for Denver metro homebuyers?

- As mortgage rates and prices continue to increase, waiting to buy will cost you. You’ll lose out on equity and lower prices. You can always refinance later on when/if mortgage rates go down.

- And remember, the slowing down of home appreciation doesn’t mean prices have gone down, it just means prices are not going up as quickly as before!

- We should see more inventory hit the market as we head into late spring and the early summer months

- Your Usaj Realty broker will help you establish your exact home criteria and set you up for success as you begin your home buying journey

- Really unsure where to start? Speak with a mortgage lender! They will be able to give you a breakdown of what you can afford and what you can expect to pay per month

If you are a home seller, consider selling sooner rather than later:

- List soon before rates go even higher: Affordability and buyer fatigue have already become a dealbreaker issue for many homebuyers as higher interest rates take hold.

- Inflation and higher rates will reduce the number of buyers shopping for a home and therefore ease the level of fierce buyer competition.

- The lack of home inventory will continue to keep home prices at lofty levels.

- Buyers are ready to purchase! Denver metro had 6,881 new homes hit the market and 5,725 go under contract.

- Spring is historically a great time to list for sellers and you can expect the process to go fast: the median days on market in April was a mere 4 days

- We are in an incredibly strong sellers’ market, with only a 0.71 months supply of inventory for single-family homes and 0.52 for condos. A 6 month’s supply is considered a balanced market: Anything less than a 1 month of supply suggests you should have multiple offers

- Our region’s current list-to-sell ratio keeps increasing and is currently at 105.42%, meaning that the average home sold for over the asking price!

- Your Usaj Realty broker can tell you your odds of selling quickly and the average numbers of showings to expect in your price range and zip code

Key Quotes from Denver Metro Association of Realtors:

- “While inventory is on the rise, so are prices. The average price of a single-family detached home in Denver Metro is $825,073, representing a 3.93 percent increase from last month.”

- “With consecutive months of increased prices and interest rates, a buyer’s monthly mortgage has increased as well. The average close-price-to-list-price ratio in April for the detached market was 107.29 percent. With the increase in supply, the close-price-to-list-price ratio is an example of how the market was reacting a month ago.”

April’s Numbers Over the Years:

| Avg. Days on Market | Avg. Sold Price: Single Family Home | Avg. Sold Price: Condo | # of New Listings | # of Homes Sold | # of Homes Pending | Avg. Sold Price Change YOY | |

| Apr. 2017 | 33 | $487,974 | $318,478 | 6,574 | 4,389 | 5,521 | + 10.53 % |

| Apr. 2018 | 20 | $543,058 | $351,488 | 6,917 | 4,384 | 6,097 | + 11.38 % |

| Apr. 2019 | 28 | $553,371 | $368,565 | 7,518 | 4,675 | 6,470 | + 1.5 % |

| Apr. 2020 | 20 | $550,177 | $379,495 | 4,679 | 3,603 | 3,280 | + 1.52 % |

| Apr. 2021 | 13 | $699,039 | $444,252 | 6,699 | 5,088 | 5,941 | + 24.2 % |

| Apr. 2022 | 8 | $825,075 | $495,078 | 6,881 | 4,912 | 5,725 | +17.11 % |

Source: DMAR

News highlights:

- “Denver moved from the country’s eighth least affordable metropolitan housing market in February to the fifth least affordable, behind Miami, in March, according to a monthly survey from OJO Labs, a real estate tech company based in Austin. Metro Denver’s median sold price has risen more than 23% in the past year to $564,990 and is now 6.6 times the median household income, the survey found.” – The Denver Post

- “Fannie Mae now forecasts that U.S. home prices will rise 10.8% in 2022. That’s a slight downward revision from March, when Fannie Mae was predicting a 11.2% jump in home prices this year.” – Fortune

- “We expect housing to slow over our forecast horizon, as well. Mortgage rates have ratcheted up dramatically over the past few months, and historically such large movements have ended with a housing slowdown. Consequently, we expect home sales, house prices, and mortgage volumes to cool over the next two years. In particular, we expect house price growth to decelerate to a pace more consistent with income growth and interest rates. Households with a 3-percent, 30-year, fixed-rate mortgage are unlikely to give that up in favor of a mortgage closer to 5 percent, and we expect this so-called ‘lock-in’ effect to weigh on home sales. Moreover, if mortgage rates remain relatively elevated, we expect the added affordability constraint to price out some would-be first-time homebuyers and contribute to the slowing of demand.” – Fannie Mae

- “151,153 U.S. properties [were distressed or foreclosed upon] in 2021, down 29 percent from 2020 and down 95 percent from a peak of nearly 2.9 million in 2010, to the lowest level since tracking began in 2005. Those 151,153 properties with foreclosure filings in 2021 represented 0.11 percent of all U.S. housing units, down from 0.16 percent in 2020 and down from a peak of 2.23 percent in 2010.” – ATTOM Data

- Odeta Kushi, the deputy chief economist at title insurance company First American, believes a housing crash similar to 2008 is unlikely to happen. “The housing market is in a much stronger position compared with a decade ago,” Kushi told Insider. “Accompanied by more rigorous lending standards, the household debt-to-income ratio is at a four-decade low and household equity near a three-decade high.” – Business Insider

Read Next: Home Buying: What to Expect When Working with Usaj Realty

During these unprecedented times, Usaj Realty would love to carefully assist you with finding your next place to call home or selling your current property. Our acumen, attention to the market, and negotiation skills will all go to work in order to advocate for your goals. Email us at info@usajrealty.com or call 720.398.2999. We measure our success by the happiness of our clients!

Read Denver Metro Association of Realtor’s full report on last month’s Real Estate trends and statistics in Denver here.

And as always, please let us know if you have any questions!

Whether buying or selling, Usaj Realty is dedicated to helping you stay competitive. Your Usaj Realty broker will communicate effectively, learn your goals like the back of their hand, and work closely with you to negotiate the best terms possible, and expertly manage your transaction from start to finish, ensuring peace of mind.

Email us at info@usajrealty.com or call 720.398.2999